Pigeons and Rabbits

I went on two walks the other day.

The first walk was in my neighborhood with the family. As we often do, we see a couple of these:

The rabbit doesn’t know we’re friendly, so each time we get within 20 feet, it hops away.

…My kids are sad; they want to pet the bunny.

…I’m sad; I want my kids to be happy.

…The rabbit is sad; she was eating our neighbor’s grass, and we disrupted her breakfast.

So, everyone is sad.

On to the second walk…

Later that day, I went for a coffee fix at the Starbucks just down the street from my office.

On the way, I pass a bunch of pigeons on the sidewalk pecking at food scraps.

The pigeons are accustomed to people walking around, they only move when I get within a foot or so.

…I’m happy I don’t have to walk into the street to get around the pigeons; they slowly move out of my way.

…The pigeons are happy; they get to keep eating scraps.

So the pigeon is better off than the rabbit — but why?

Well, for one, the pigeon knows something about me that the rabbit does not: the pigeon knows Adam (and most humans) are not a threat.

The pigeon gets its food from urban sources, which regularly exposes it to humans and causes it to learn our habits. The pigeon sees that we’re not only not dangerous, but, in fact, we’re actually a critical part of its survival (as I accidentally let a crumb from my croissant fall on the ground to be eaten).

The pigeon is used to the chaos of the world and the presence of people.

The rabbit could learn a lot from the pigeon.

In fact, investors can learn a lot from the pigeon too.

What can investors learn from a pigeon?

It’s pretty clear now that our policy for dealing with bad economic headlines is loose monetary policy. This helicopter money is a shot of morphine to help deal with the original discomfort, but it ends up spreading out that discomfort down the road in the form of a price increases.

Investors, like pigeons, need to eat. Not only today, but also in the future. Simply put, we may be impacted by inflation.

See the chart below showing the 2022 spike in CPI as a result of our morphine shot in 2020.

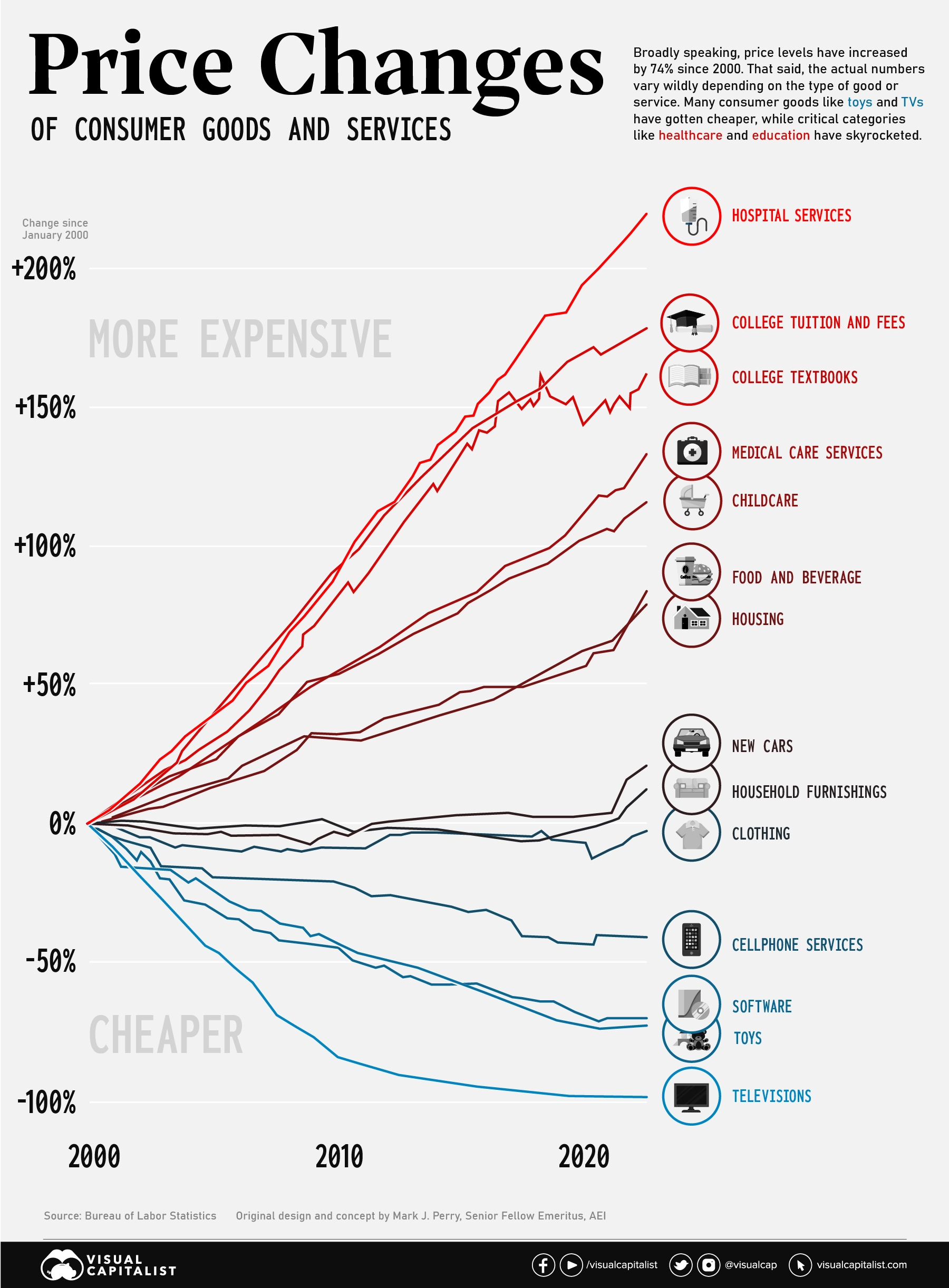

The above chart doesn’t tell the story of how inflation compounds… But this one does:

The nuance to adopting an investment strategy as part of a thoughtful financial plan is that you’re not subjected to dealing with one single kind of price increases for the stuff you need to buy.

…The cost of college, daycare, healthcare, and long term care/assisted living have each exceeded core CPI.

…The cost of flat screen TVs has seen deflation.

Unfortunately, a lot of the things we can’t live without are getting more expensive while the optional things are getting cheaper.

And, to make things more difficult, you don’t know exactly when you’re going to have a huge spike in healthcare costs or have a need for assisted living or what kind of college your kids might go to. There’s a certain amount of unavoidable chaos you’re going to have in your life. So, when dealing with inflation — I feel like it’s important to embrace your inner pigeon and try to benefit from getting comfortable being near chaos — or volatility.

So, here’s what I suggest:

Start with a guess.

That’s right. Throw out your best guess for how much the cost of certain things will be and when you’ll need it. You’re going to be wrong but that’s okay. Once you have that timeline and target dollar amount, you can get comfortable with short term market chaos because that invested money isn’t for You, it’s for Future You.

Then you simply need to revisit those guesses and adjust as new information comes to light.

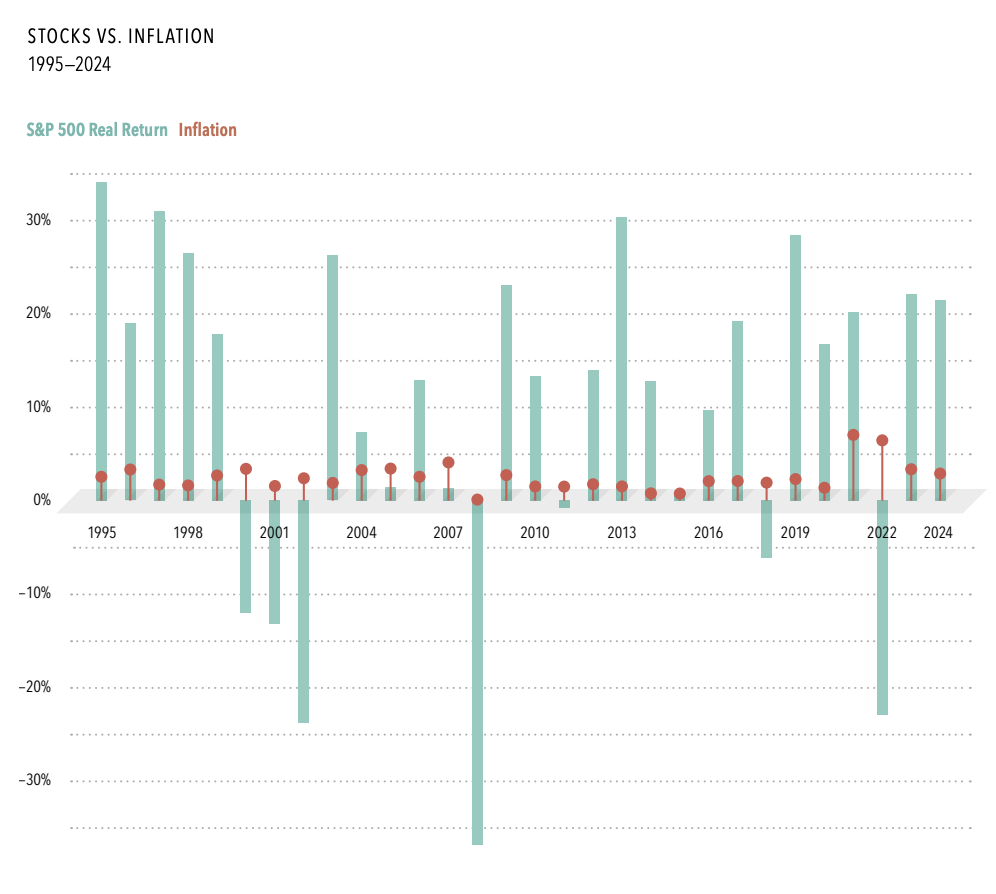

Sometimes you have to get comfortable with risk to get what you want. Like the presence of humans to the pigeon, stocks may not only be not dangerous, to investors, but, in fact, may be a critical part of their survival.

Here is how stocks (a volatile investment) have faired relative to inflation over the last 30 years.

Okay, that’s enough about pigeons (for now… who knows what I might come up with in 2026).

I’ll leave you with one last thing.

To understand why we like stocks as a way to combat long term inflationary pressures, here’s what I want you to remember:

Everyone is worried about not being able to afford the things they need.

Actually, let’s call it what it really is… Fear.

And fear, my friends, is an incredible motivator.

How does that motivation affect what people do with their time and energy?

The idea is that the time and energy they spend at work is filled with trying to find ways to boost their income. And the most surefire way to do this is by helping boost their company’s profits.

So, if you’ve worked hard enough to be retired (or near it) and have financial assets instead of large amounts of time and energy, I want you to consider making a bet on those who don’t have the assets but do have the time. Partner with them in how they address their fears (by excelling in their workplaces for their own benefit and that of their companies) by owning stocks to help you buy stuff down the road.

Until my next allegory,

Adam Harding | CFP® | meet with me

480-205-1743

www.hardingwealth.com

Past performance is no guarantee of future results. Short-term performance results should be considered in connection with longer-term performance results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.