The Time I Became Famous

Last year I became famous for about 4 days.

How?

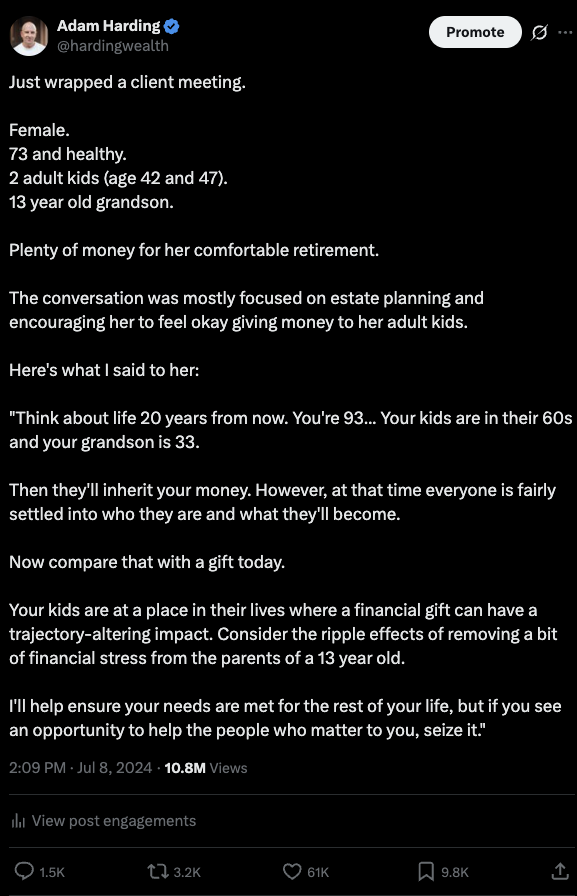

I wrote this (and it went viral).

11 million views, 61,000 likes, 3,200 reshares and 1,500 comments… That’s a lot of outreach. But don’t worry, the fame didn’t go to my head.

The reaction was visceral from all sides.

The older generation of commenters fell into two camps:

(1) they wanted to help but were unsure of how much is sensible given the astronomical cost of care and assisted living later in life, or

(2) they felt like their personal struggles when they were young helped shape their character as savers and investors and they don’t want to steal that character-building opportunity from their kids.

The younger generation of commenters also fell into two camps:

(1) they would love some reasonable assistance as they’re faced with the most unaffordable housing market in history, daycare is as expensive as going to college, and core inflation was at a 4 decade high as recently as 2023, or

(2) they want their parents to live and enjoy the byproduct of their sacrifices made in earlier years. If there’s an inheritance later on, so be it.

… Everyone has extremely valid arguments, but it’s all circumstantial. For some people, a safety net is a last resort. For others, it’s a hammock to take a nap in. That’s why the “giving advice” I provide for some clients may vary dramatically depending on the people and circumstances involved, not just the financials.

In the days following this viral post, interviews and articles arose from Yahoo Finance (link), The Financial Post (link), The Wall Street Journal’s Marketwatch (link), and many others.

Over the years I’ve encountered people who are giving more than they can afford to, and those who I can confidently declare will never run out of money, but still refrain from giving because they’re scared of being broke.

As an advisor, my worst nightmare is watching someone deplete their assets and go from riches to rags….

But not far behind that nightmare is the possibility of watching a wealthy benefactor see their adult children sacrifice their relationship with their family (kids and spouse), while working long hours, and carrying stress in exchange for money they don’t actually need when an inheritance eventually hits.

So if you’re grappling with this, I get it. It’s a tricky line to walk but I’m glad to help you walk it if you need an outside opinion.

Until then, here’s a short list of things to remember:

1) If you’ve accumulated enough to not need help from your adult children, that is a form of generational wealth. You maintaining your independence has economic value to your kids as they can earn, save and invest without supporting extended family. Feel good about that.

2) If you’re new to giving to your kids, start with a targeted strategy. As an example, let’s say your 23 year old child or grandchild is working, making a $50k salary. It’s hard to tell that young worker to put $7k into their Roth IRA — at this income level it’s not like they’re swimming in extra cash to set aside for 40 years down the road. In this case, you can give them the $7k for their Roth and educate them about the benefits of long-term thinking and the tax advantages of a Roth IRA. Solid starting place.

3) Giving the same amount on a recurring basis (a couple thousand a month or a big gift each year at Christmas) can breed a lot more reliance on that cash flow than more sporadic gifts. Know the personalities of those you’re giving to and determine which kind of support you want to provide.

4) Most people don’t need to worry about the gift tax limit of $19,000 per person per year. If you give someone more than that, like $19,001, for example, then you simply add that extra $1 onto the value of your estate when you die. Under current rule, your estate would have to be more than $13.99 million for there to be taxes owed at the federal level (or double that for a married couple). So if you’re worth $5 million and want to give a kid $25,000 you can do it (but maybe have you give $10k and your spouse give $10k in this case just to simplify your tax filings).

5) If you want to give to charities, know your options: Qualified Charitable Distributions from retirement accounts, gifting low basis securities from taxable accounts, donor advised funds, family foundations, etc.

_________

At the end of the day, this is an incredibly nuanced subject and 9 times out of 10 you should just do what feels right for you and your family. That remaining time might be when you get our opinion on it.

That’s all for now.

Adam Harding