Predictions

Everyone has things they love around this time of year: the lights, the music, the holiday spirit — and as we wrap up 2025, Wall Street and the financial entertainment industry LOVES making predictions about what’s going to happen next year in the markets — and you and basically every other investor with a pulse loves paying attention to those predictions.

I get it, it’s uncomfortable to not know what’s going to happen to us in the future, so we listen to people who sound smart when they try to quell some of that uncertainty.

But even though I love you guys, I’ve gotta hit you with some tough love:

You’re too smart to care about those predictions. Stop.

For a great example of why these predictions aren’t worth caring about, I want you to hop into my time machine and zoom back to a time long ago: 2024.

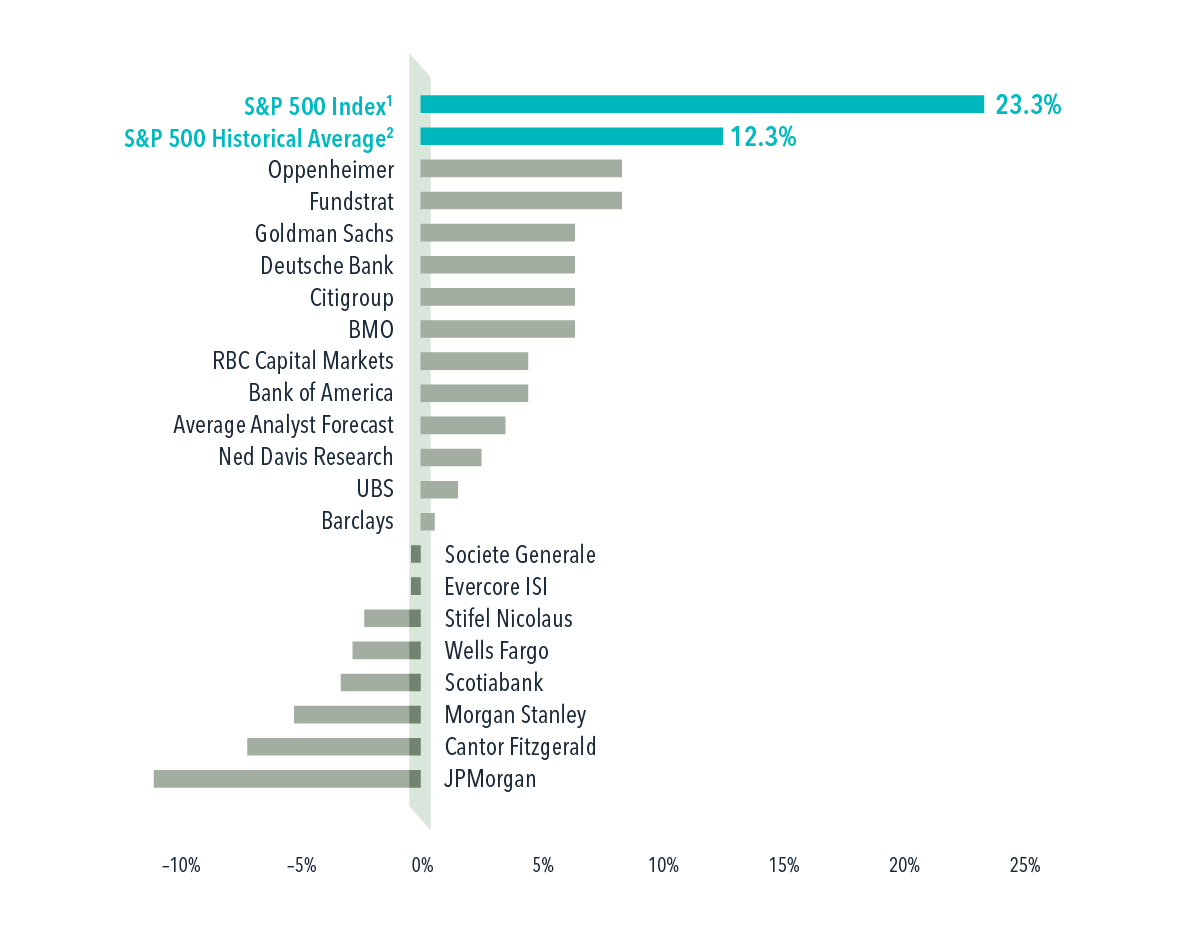

The S&P 500 Index rose by 23.3% in 2024.

This far exceeded expectations from analysts polled at the end of 2023, none of whom believed the S&P would grow by its historical average rate of return, 12.3%. In fact, nearly half of the analysts predicted a negative year for the index.

Source: Dimensional

I need you to dwell on those names above for a minute.

Goldman Sachs…

Bank of America (Merrill Lynch)…

JP Morgan…

Now think of the tools available at their disposal to help improve forecasting capabilities:

Bottomless budgets to hire the smartest people,

informational advantages due to their business relationships

analysts working until 7pm on Christmas Eve.

All of that just to be astonishingly wrong not just in 2024, but nearly every year.

So if you need a good reason to discard your cousin Marvin’s investment advice he gives you on Christmas this year, feel free to remember how wrong the smartest people in the world tend to be and then react to his opinions accordingly.

”Okay, Adam, thanks for telling me what I should ignore. So, now what? What should I care about for next year?”

I’m glad you hypothetically asked. That blog is coming in the first week of 2026. Stay tuned.

But in the meantime, I’m going to leave you with one more thing from 2024.

Remember the Presidential Election?

This was another situation where the supposed experts were wildly wrong about their predictions. Most were expecting a closer race that was much more up for grabs than the outcome showed.

But one group of analysts nailed the prediction: The Betting Markets — specifically, Polymarket.

Instead of opinions or surveys, Polymarket reflects where millions of people are willing to put real money. As new information arrived—polls, debates, late-cycle developments—the market adjusted quickly.

While many analysts continued to describe the race as a toss-up. Polymarket didn’t. Its prices consistently pointed toward a clearer outcome well before Election Day. That doesn’t mean the market was perfect, but it was doing something familiar to investors: aggregating lots of scattered information into a single, evolving signal.

This is essentially the efficient-markets idea at work. When participants have incentives to be right, not just loud, information gets absorbed faster than most commentary.

Going forward, remember that current prices of the investments you own or are considering owning are reflective of billions of market participants making daily decisions, each with their own unique perspective and information about those investments.

But also, those market participants (including you), should be making choices based on your life, what you need money for, when you need it, and how well you sleep at night while adopting different degrees of risk. Focus on the stuff that matters.

We’ll unpack more of this in the next few blogs.

Happy Holidays,

Adam Harding