The benefits of being dead.

Halloween is coming up, which makes this a great time to remind you who the best investors are: The Dead.

Fidelity reportedly analyzed which accounts performed best over time. The top performers? Those belonging to investors who had died — or simply never logged in.

The reason? The portfolios of the deceased didn’t react to fear. They didn’t sell in 2008, chase tech in 2000, or panic during COVID. They didn’t listen to their boisterous uncle who was insistent they were missing out on “The Next Great Thing” if they didn’t buy “Company XYZ”…

Living investors believe they can outsmart the market; they trade too much and get burned.

Every bear market tempts investors to flee. The dead, unafraid, ride it out.

A portfolio left untouched can quietly compound, feeding on time instead of trades.

Costs, taxes, and timing kill more returns than any monster. The dead avoid them by doing… nothing.

To be clear, the downsides of being an alive investor aren’t reserved solely for you and me. They’re also present for investors who look like this:

You know these guys, right?

These are the guys who work 12 hours a day.

These are the guys who work on Christmas.

These are the guys who tune into earnings calls and read every forecast.

But these are the guys who also charge huge management fees for their…expertise.

So let’s review the track record of their expertise.

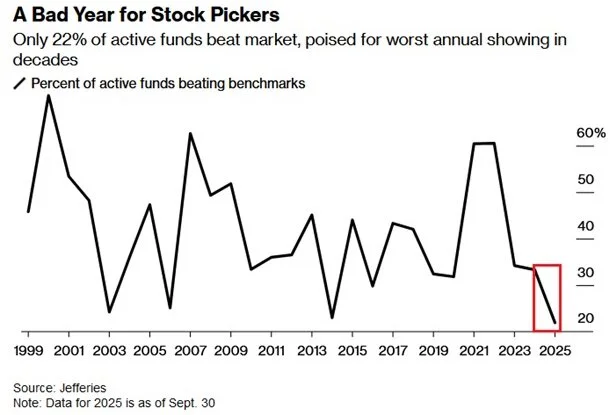

Exhibit A:

To reiterate the above chart, just 22% of the actively managed stock picking mutual funds are beating their index benchmarks despite a massive deployment of resources to try and do just that.

But this isn’t just a 2025 observation. Here is the last 10, 15, and 20 years to compare to:

Past performance is no guarantee of future results.

The above graphic highlights how unlikely it is for stock funds to outperform their benchmarks over long periods of time — and, in many cases, the funds don’t even survive (funds often close due to poor performance).

A few years back I was delivering similar data to a room of retirees and one crowd member said “Adam, this pertains to actively managed mutual funds, not individual stocks. I prefer individual stocks so this doesn’t apply.”

Here’s what I told him:

”Thanks for the comment. Let’s envision a scenario where your individual stock picks have been amazing — and perhaps they have been.

How long would it take for your friends to start asking you for advice on their stock portfolios?

And once they ask for your good advice and start reaping the benefits and start telling their friends, at what point do you think, perhaps I should charge for this advice?

So you open an investment firm and start managing their portfolios for a fee.

Let’s assume your stock picks continue to be incredible and the demand for your services is incredibly high. At this point you start looking at how you can get your investment ideas out to the masses in the most broad, democratized way possible.

And this, my friend, is where you realize the mutual fund presents the best structure for delivering your advice.

So when I present the above data regarding actively managed investment strategies, I want you to remember all of the steps which took place before these funds were even launched.”

Okay, back to being dead.

We often see investors who’ve committed to chasing the current theme or who are a bit too “in-the-news”. This is normal human behavior. Our job is to help you adopt more nonhuman behavior without putting you in the graveyard.

We believe that great investing isn’t about predicting the next market scare — it’s about surviving it. The best portfolios are built for endurance, not excitement. In a world obsessed with the next move, sometimes the most powerful move is none at all.

And with that, I’ll leave you with two things:

1) The chart above with 10, 15, and 20 year performance of actively managed funds is from Dimensional’s Mutual Fund Landscape report. If you want the whole thing, let me know and I’ll send it over.

2) Being a Wealth Management Firm instead of an Investment Firm gives us an advantage. The reason: we only care about outcomes. People come to us and say things like “I want to retire at age 63 and have $X/month income” or “We want to buy a second home next year to be closer to our grandchildren”…When we’re focused on an outcome specific to a client’s objectives, our egos don’t tied up in the daily distractions.

Success isn’t defined by how well we participate in the AI craze of 2025 (or whatever flavor of the month is pervasive at that time), it’s defined by longer term accumulation and shorter term risk management. Given this focus, we maintain the full flexibility to align ourselves with whatever investment philosophy we think provides the highest likelihood of meeting those objectives.

For now, that philosophy more closely resembles the typical dead investor than the living ones.

(Although we do think the dead investors could take advantage of some of our tax alpha strategies we’ve been reviewing in client meetings recently. Here’s the link for that discussion: tax meeting)

That’s all for today.

Adam Harding

Advisor | Owner of the House that Gives Out Full Sized Candy Bars at Halloween