A Simple Trick

I have a trick to help you deal with the next market correction.

And, look, I get it, market corrections aren’t enticing to talk about when the market isn’t correcting — it’s like trying to sell someone an umbrella when it’s cloudless and sunny, but if you wait until the storm is here not only will your decision-making be impacted by your rain-soaked attire, but everyone else will want those same umbrellas.

So, I often talk about these tactics before you actually need them. Let’s go.

The Trick

Here’s what I want you to do:

Step 1: Calculate the value of your total portfolio

Step 2: Do some math to find out what your portfolio size would look like if it were 10% less than it is today. Do this again at 20%. These are your hypothetical ‘post-crash’ portfolio values.

Step 3: Try to revisit the history of your portfolio to find a time when you had the same amount as those 'post-crash’ values from Step 2.

Here’s a hypothetical example:

*Not a representation or advertisement of portfolio performance. Past performance is not a guarantee of future performance.

As you can see above, the current portfolio value is $2.84 million.

A 10% drop would have the portfolio value at $2.55m.

The last time this portfolio was at around $2.55m? April of this year.

A 20% drop would have it at $2.27m.

The last time this portfolio was at around $2.27m? November of 2023.

Here’s the important part…

Now you have to ask yourself, “How did I feel back when my portfolio was this same exact value but things were on the way up rather than on the way down?”

The answer is usually “I felt great.”

And that, my friends, is the trick. If you have some kind of access to historical data like this (all of our clients do), I recommend taking a look at what your overall portfolio value would be post-crash and then retrace your footsteps to find out the last time you were that “poor”…

Turns out you might feel better about it. Keep this tactic in your back pocket for when you need it…. And if you genuinely can’t afford to lose 10% or 20%? Then it might be time for a strategy shift. Glad to help with that determination if you need a second opinion (send an email).

One last thing…

The Fed cut rates again yesterday and it reminded me of how different things are now than just a couple decades ago.

Here’s text from a May 28th, 1999 article

“NEW YORK (CNNfn) - Analysts clamoring for clues on the direction of interest rates have one last resort: the briefcase theory, which holds that the size of Alan Greenspan’s briefcase offers insight into upcoming changes in lending policy.

If Federal Reserve Chairman Alan Greenspan is pushing to raise rates, he’ll walk into the Federal Open Market Committee meeting with a large briefcase, because the Fed chief will need documentation to back up his case.

If the briefcase is light, it’s a signal Greenspan wants to keep rates unchanged.

As Greenspan walked into Tuesday’s FOMC meeting, his briefcase appeared light by historical standards, supporting expectations of most analysts who see the FOMC leaving the federal funds rate at 4.75 percent.

The federal funds rate has been at that level since Nov. 17. Before that, the Fed cut rates three times, each by a quarter of a percentage point, to bolster the economy from overseas turmoil.

But last week’s Labor Department report that consumer prices rose 0.7 percent in April — the biggest rise in more than 8-1/2 years — means inflation is suddenly a concern again.

This has caused a few analysts to predict a rate tightening Tuesday. Others, however, see the Fed shifting its bias, or inclination, to raising rates at its next meeting six weeks away.

The Fed’s Open Market Committee began its meeting on time Tuesday morning. An announcement on the committee’s stance is expected later in the day.”— CNN Money

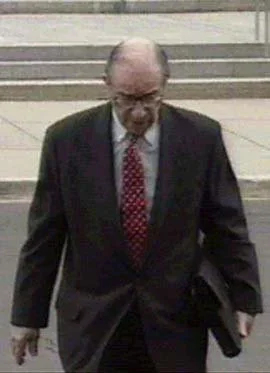

Alan Greenspan and his briefcase

The times and tools for forecasting interest rates have changed, but people stay the same.

That’s all for now.

Onward,

Adam Harding

Advisor

www.hardingwealth.com

*For informational purposes only.