How to do a tax meeting

Right now, you should be thinking about your taxes.

If that underlined word made you throw up a little, this post is for you.

Taxes are the single largest expense each of us will face over our life time. But the tax code is complex, and changes frequently. Trying to find good, personalized tax advice is difficult. So most people wing it.

You aren’t crazy for trying to avoid thinking about taxes all together. But there’s a better way, and we want to help.

The Tax Meeting

Each year, starting in October, we have a tax planning meeting with our clients.

Here’s what it looks like.

We send you a secure link, and you upload your most recent tax return.

We review your tax return. And create your tax report.

We have a conversation together, and review your tax report.

This blog will look at what items are in that tax report and how they may help in relation to your tax planning.

I’d like to quickly highlight the difference between tax preparation and tax planning. A common issue is— people hire a tax preparer and assume they are going to get tax planning, but that rarely happens.

Tax Preparation: Is the process of completing your tax return each year. This is the job of a tax professional, like a CPA or a Enrolled Agent. Most tax preparers do not get paid to do tax planning. Their job is to accurately file your tax return for the current year.

Tax Planning: Is the art of minimizing your lifetime tax liability over time. This is the job of a planning professional, like a CFP or CPA. The best tax planning is often a collaborative process between your financial advisor and your tax preparer.

Talking about taxes is difficult because it is always situational. We can’t possibly highlight every situation in a single blog post. If you’re interested in getting a personal review of your tax outlook— schedule some time with us here.

New Tax Rules for 2025— How the Math is Shifting.

This has been a fun year for tax planning (yes, “fun”)… There are several new wrinkles to plan around, we appreciate the challenge.

Here’s one example:

I’m sure you’ve heard “no tax on Social Security” as part of the new tax bill passed in 2025. That wording is misleading. The tax bill gave seniors age 65+ a new deduction to offset taxable income. Social Security income remains taxable.

Enhanced senior deduction: New temporary deduction for for those age 65+. This is an additional deduction of taxable income, $6,000 single, or $12,000 married. This deduction phases out on income above $75,000 single and $150,000 married.

For many retirees, this new deduction may open up more of the 12% tax bracket for Roth conversions.

Without getting to far down the weeds let’s use a marginal tax rate chart to model this.

Client scenario:

-Married file jointly.

-Has large pretax account (Traditional IRA or 401K etc.)

-$60k of gross social security is their only income source.

1) You see that purple zone on the chart below? That represents when the social security dollars start getting taxed. That starts to happen for married couples at around $28,000 of taxable income. Even though their in the 12% tax bracket, the marginal tax rate they are paying for dollars in the purple zone is closer to ~22%. (told you the tax code is complicated).

2) The new senior deduction offset a chunk of additional taxable income. Think about it as an eraser that pulls down the tax rate on some of that purple zone.

3) This can change the math on Roth conversions for people in this situation. Now, it may make sense to accelerate income past the lowered purple zone, to bust through to the hole to the right of the purple. That hole is the sweet spot. It is the 12% marginal tax rate.

This shifts the calculus on if and how much Roth conversion may be right for you. This client was able to convert an additional $40k, than they were previously.

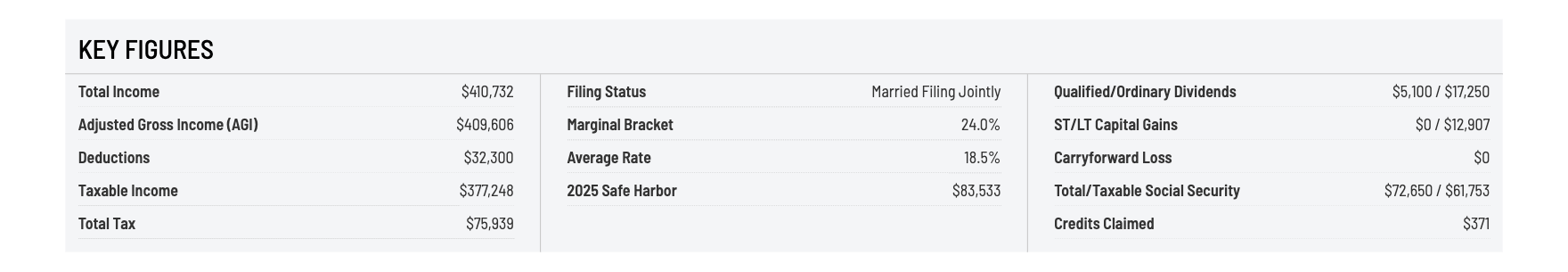

From this summary we can start a meaningful conversation about tax rates, current year estimates (“2025 Safe Harbor”), and the kinds of taxes you pay.

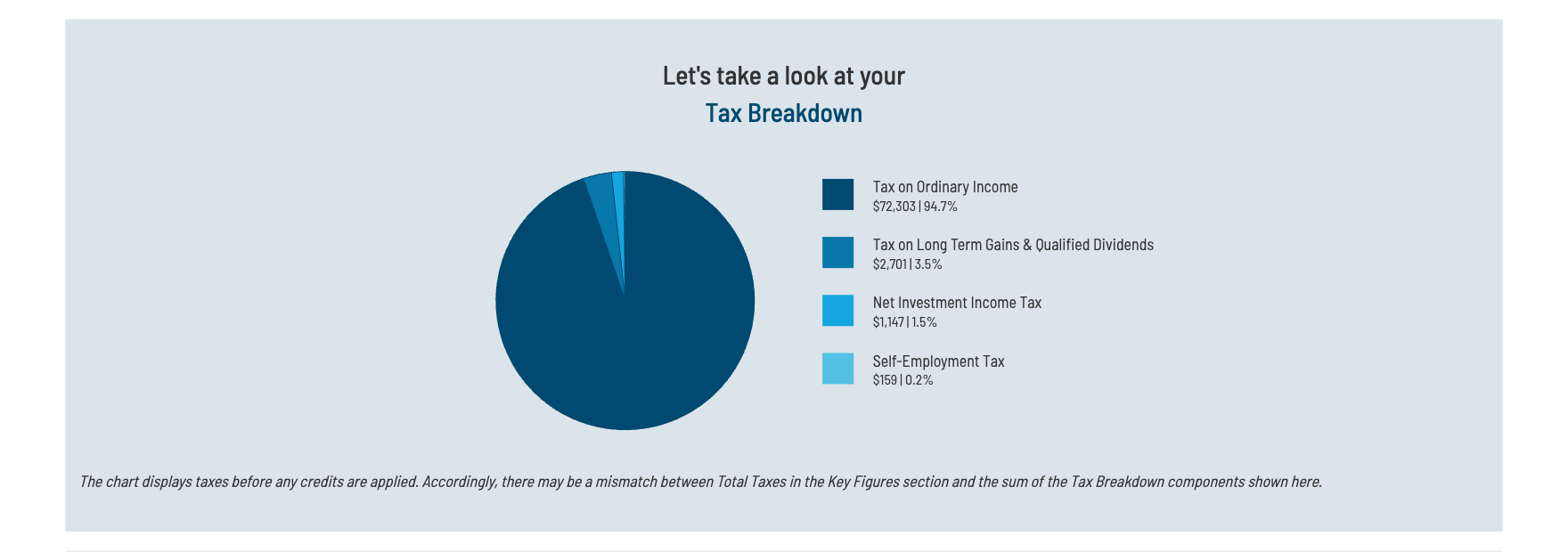

This section is a simple visual highlighting the breakdown of a client’s tax bill. This allows us to start identifying the areas to focus.

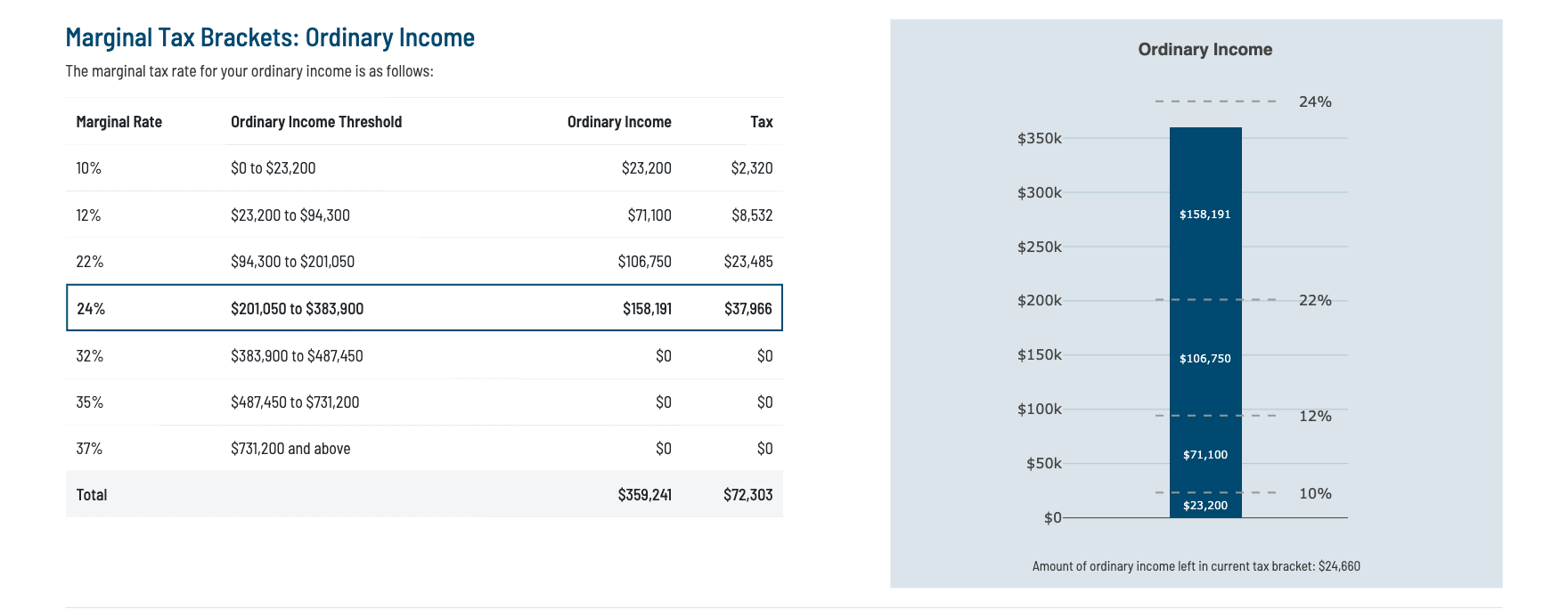

The above graphic shows how the Federal income tax brackets are progressive. Each tax bracket is filled up, before the next tax bracket starts. This is true for everyone.

Elon Musk’s first $23,200 of income is taxed at 10%, just like mine. Then his next $71,100 of income is taxed at 12%, just like mine.

And so on.

Your marginal tax rate, is the tax bracket your last dollar is taxed in. For the example in the graphic above, the marginal tax rate 24%.

Elon’s marginal tax rate would be 37%.

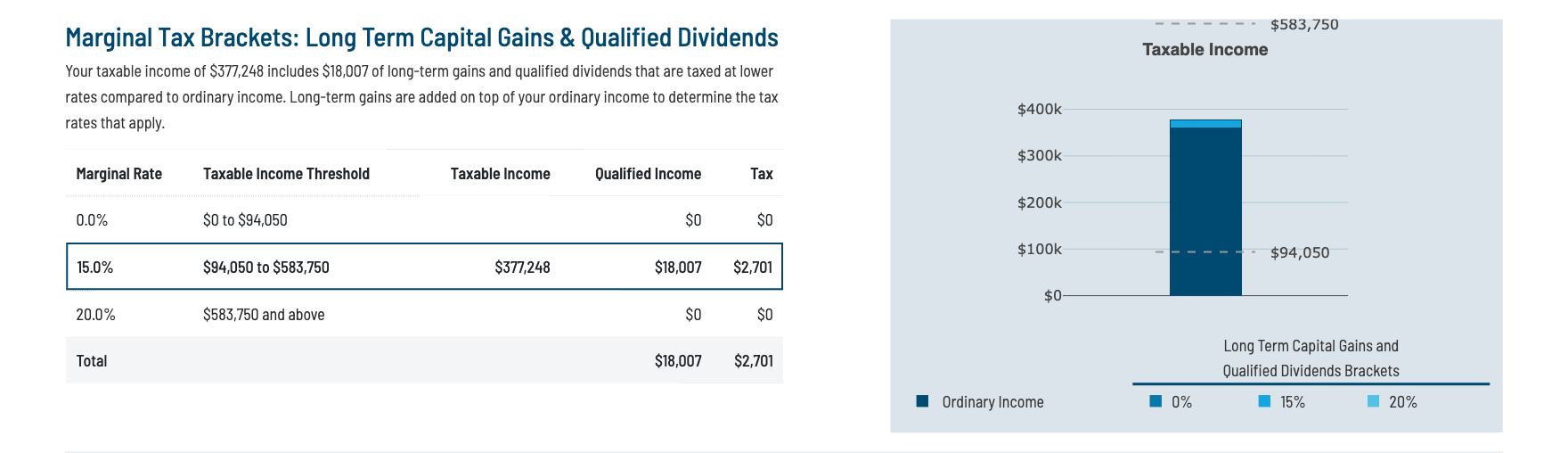

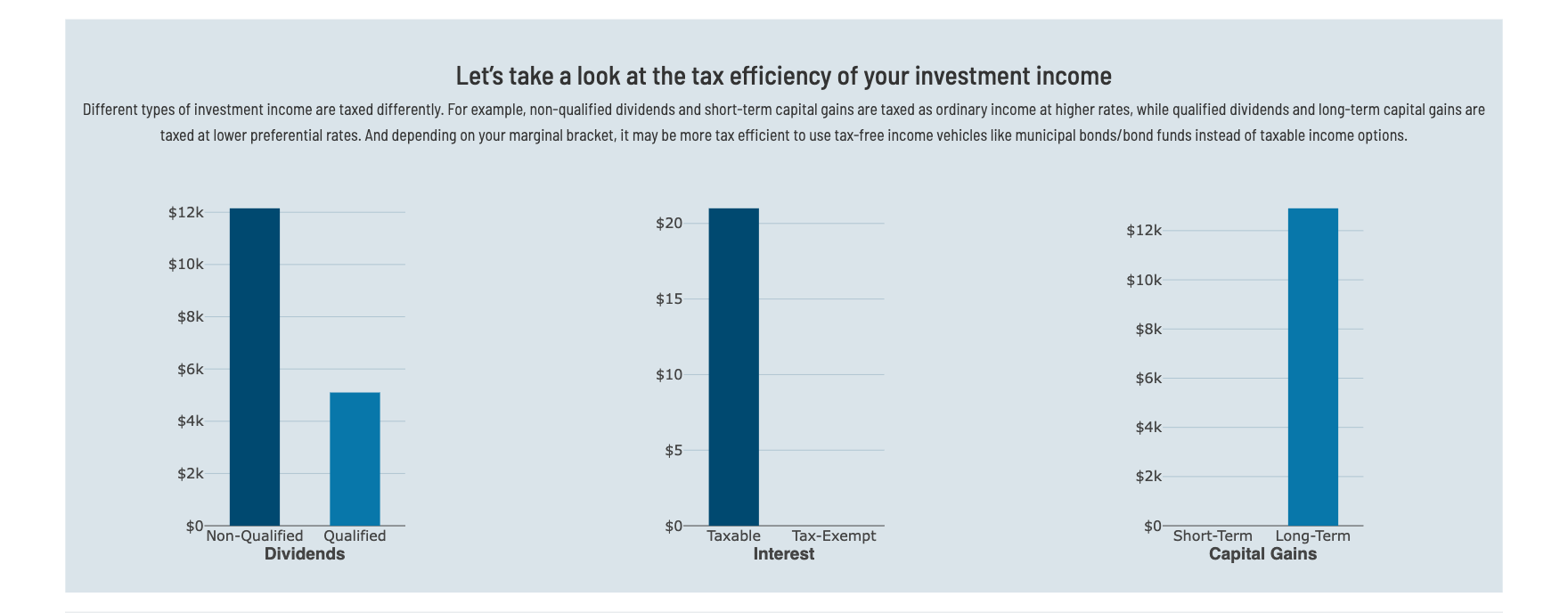

The tax code was designed to incentivize our citizens to invest. It rewards investment by taxing it at a lower rate than income.

An investment that is held for longer than 1 year, has advantaged tax brackets. Here’s a few things to catch:

1) There is a 0% tax bracket for capital gains. For certain situations, this presents great tax planning opportunities.

2) A $500,000 capital gain, has a 15% marginal tax rate. $500,000 of ordinary income, has a 35% marginal tax rate.

3) Most people fall into two different marginal tax rates. As shown in the graph below.

How much seniors pay for their part B/D Medicare premiums depends on how much income (MAGI) they have. You may have heard this termed “IRMAA” (income related monthly adjustment amount). These income thresholds are cliffs. If your income goes 1 dollar into the next bracket, you will pay the adjusted premium of that bracket.

IRMMA premiums are important to consider, but should not drive the bus of your decision making.

Okay, if you’re still with me, I applaud you — this stuff is important but it isn’t much fun. Frankly, navigating “stuff that isn’t fun” is a big reason why Harding Wealth exists…we like it.

We do a hundred of these strategy meetings a year. We’re good at it. We know how to spot opportunities, and we know the tax code and we know when and how to coordinate with your CPA.

Some years there are big tax moves to make. Other years there is nothing to do, and we will probably talk about your grandkids or your most recent trip.

But the act of having a tax planning meeting is valuable, even if it leads to no new actions.

Many times the start of a new tax strategy is born out of a conversation where it looked like there was nothing to do. But then a client mentioned something important to them, like some income from a side gig, giving to a cause, or a specific way to help their children. That conversation then opened up a whole new door that had not been explored.

That’s all for now.

Onward,

Adam Harding

CFP® | Advisor

Send me an email

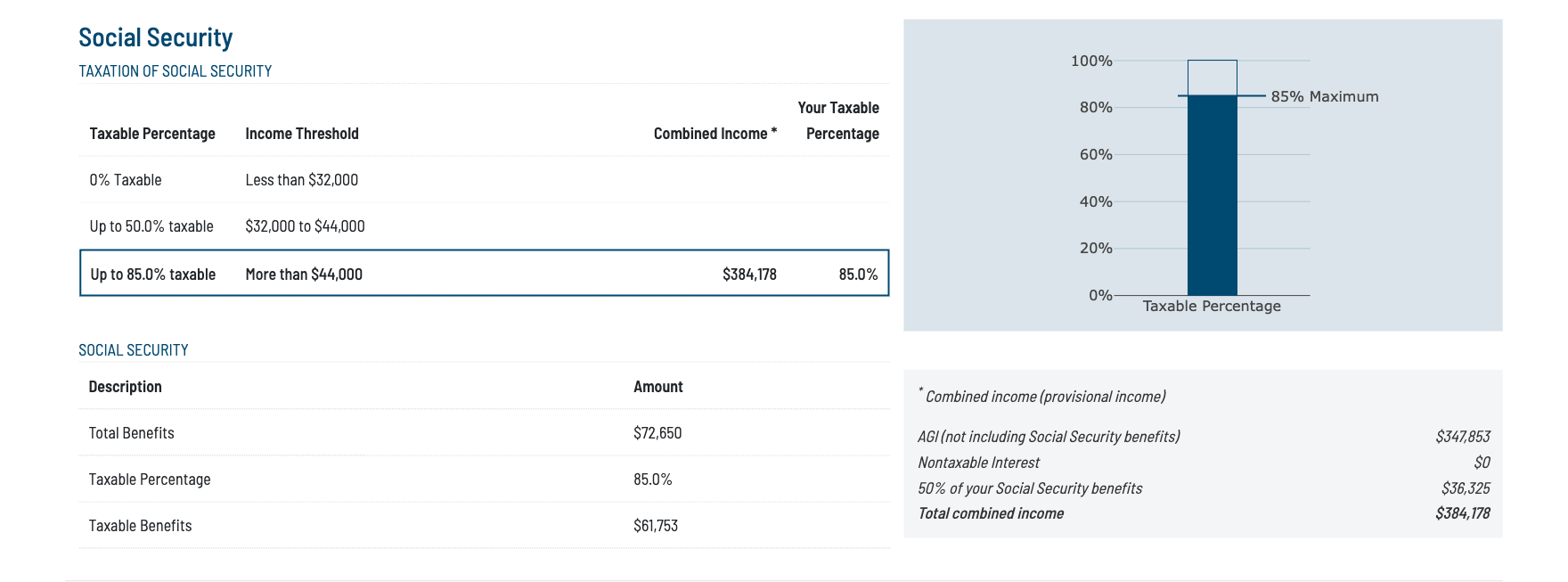

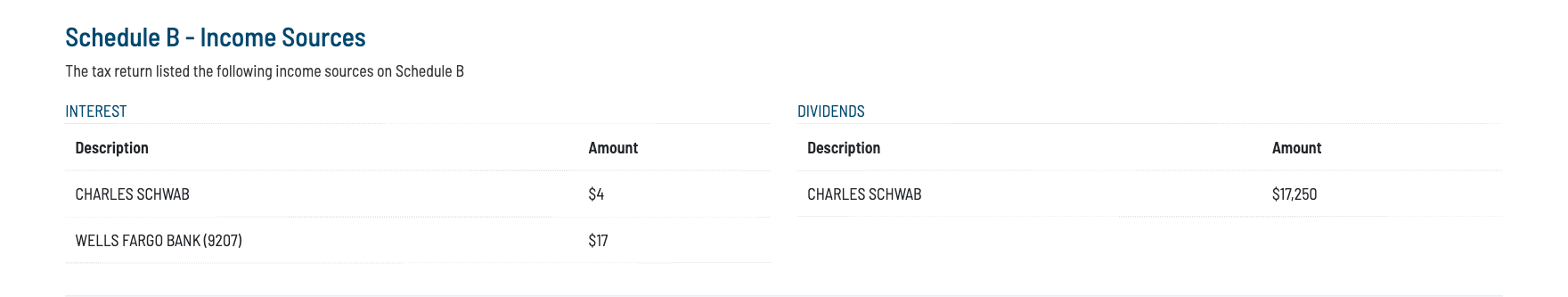

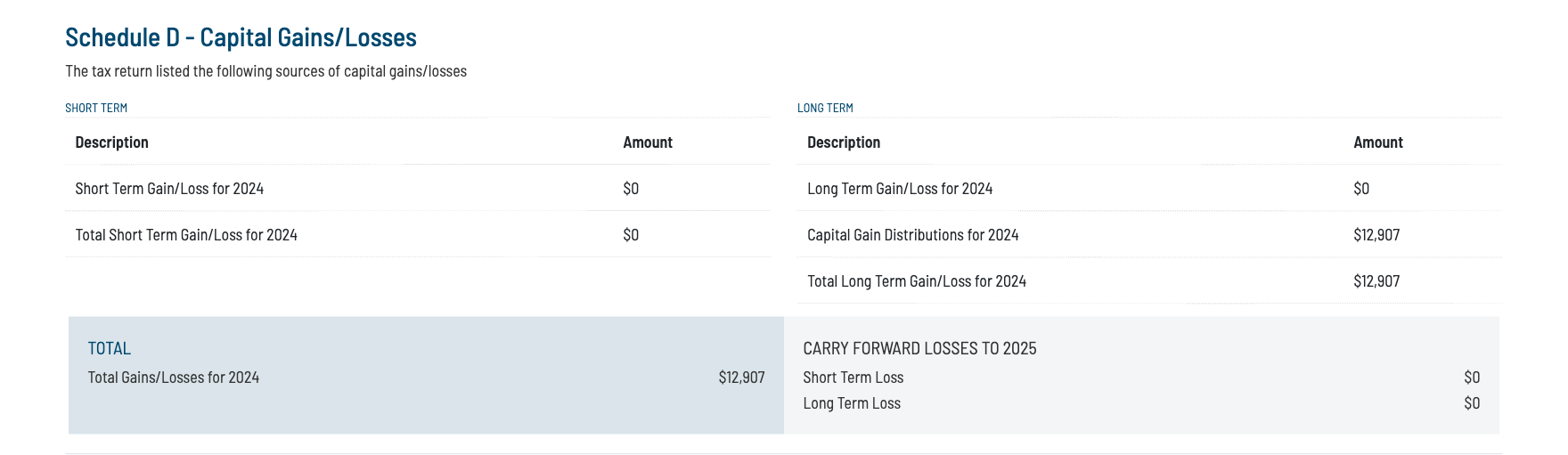

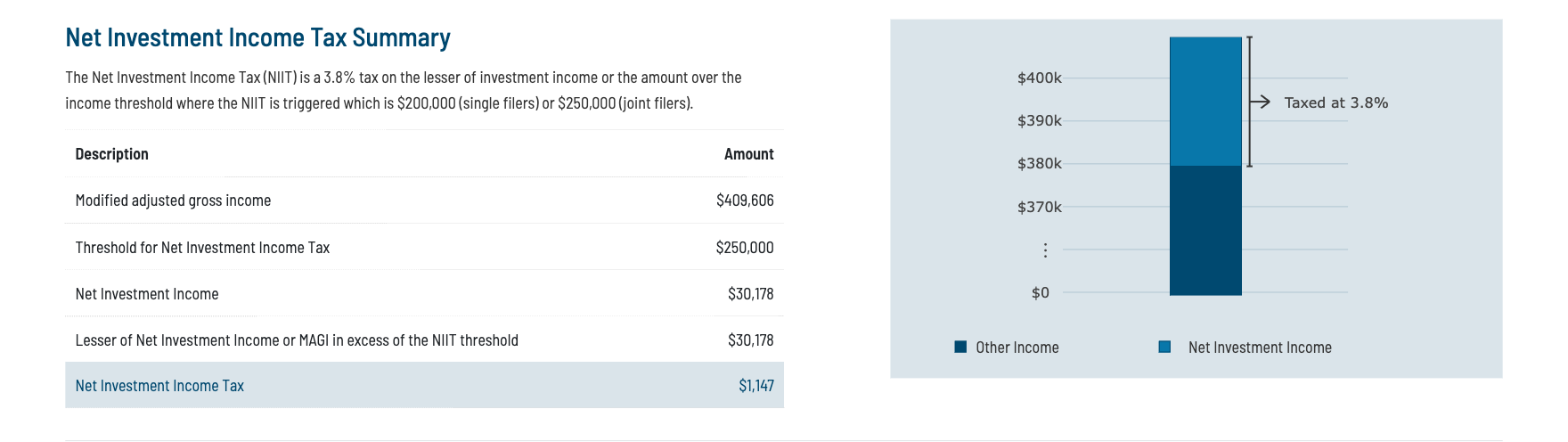

PS… The tax report contains a lot more information than what is above, but I didn’t want to overwhelm. Below are examples of those supplemental sections: Social Security Taxation, Schedule B income sources (Schedule C would be available as well, but not in this example), Schedule D Capital Gains and Losses, Net Investment Income Tax, Deductions and Credits, and A Summation of Planning Opportunities. Enjoy ;)

Supplemental Sections

*For informational purposes only. Not tax, investment or legal advice.