Tricking You Into Optimism

“Once you have ordinary intelligence, then what you need is the temperament to control urges that get others into trouble.”

-Warren Buffett

I’ve been holding a lot of client meetings recently and in these meetings we try to unpack the economic and financial strife we’re dealing with while looking to build some optimism about the future to keep us on track. (if we haven’t talked yet, here’s my calendar link)

Optimism is important.

Optimism helps people visualize a story of the future which is better than today.

…This is what causes people to get an education. Think of all the pent up optimism (and potential) which is occurring around the country at high school and collegiate graduation ceremonies this month. Amazing.

…This is what inspires people to create the next life-saving treatment or entertaining sitcom or rollercoaster theme park.

…This is why people have kids.

And you know what? I do think the future is going to be better, but if you spend too much time online on keep your eyes glued to cable news, convincing yourself to be optimistic is a nearly impossible task.

I feel like it’s important to step away from time to time just to get away from the news, but for now let’s try to trick you into being optimistic in the face of it all.

In environments like this, we need tricks. I hope this helps you stick with your long term plan…

Trick Number One:

Retrace Your Footsteps

If you’re a normal person, you hate seeing the YTD losses in your portfolio — and aside from energy stocks, there has been very little to feel optimistic about in the financial markets.

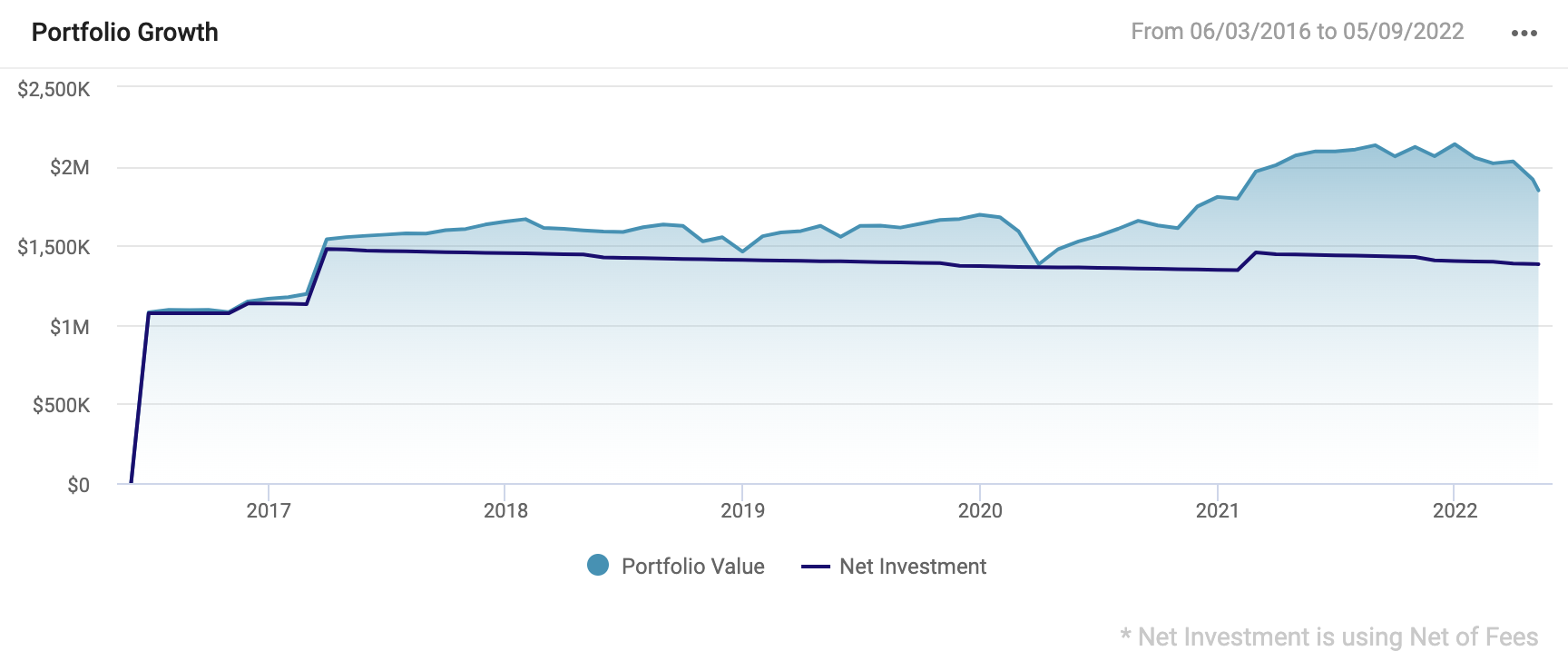

Below is a chart showing the growth of wealth of an investor’s portfolio. This is totally hypothetical — I cannot stress this enough— and it is not an advertisement of performance.

However, what it does show is a recent dip in 2022, a big dip in 2020, and an easy-to-forget dip at the end of 2018. The past dips are things many investors experienced at the time, but they are also things which we all survived. The current dip feels terrible because we’re in the middle of it right now, but is there any reason to suggest it won’t end up being similar to past declines? Only time will tell.

If you have some kind of access to historical data like this (all of our clients do), I recommend taking a look at what your overall portfolio value is today and then retrace your footsteps to find out the last time you were this poor. (In the chart above, this portfolio was last at this level in early 2021).

… and then when you find out the last time you were this poor, maybe you realize that it wasn’t too long ago.

… and then maybe you realize that you didn’t actually feel “poor” the last time you only had this amount of accumulated wealth.

… and then maybe you can say “Okay, so if I was happy back then, why shouldn’t I be happy now?”

This helps me, I think it will help you.

With that said, I know it’s hard to give up your recent gains even if you were happy before you got them…. it kind of reminds me of last weekend with my son.

We walked to our neighborhood Dutch Bros coffee shop as we regularly do. I always get a cold brew coffee, he gets a kids’ smoothie.

Only this time they accidentally made two smoothies for us and let us keep both. Here’s a picture of him with the two smoothies:

What does not get pictured above a few minutes later when I attempted to take his second smoothie to save it for later for him. He wasn’t happy with my attempt to take one, he wanted both right now.

…You see, he was always happy with one smoothie, then unexpectedly got two, and was unhappy when I tried to take the extra one away.

It’s all human nature, but as much as you possibly can, I recommend trying to bring your mindset back to the place it was in when you only had one metaphorical smoothie. It should help you feel better about the state of things.

Trick Number Two:

How Will You Know When Things Have Turned for the Positive?

The news is pretty bad, right? Inflation, war, rising rates, recession, political divide, etc etc etc. Not a lot of optimism out there.

I often get asked “can’t we just sell investments, sit in cash, and then wait for the news to get better before buying back in?”

If you’ve ever had this thought, I completely understand where you’re coming from. I manage portfolios professionally and still have this thought regularly — it’s a tempting notion that I would likely succumb to if it weren’t for the evidence suggesting that it won’t lead to a better outcome over the long term, and long term outcomes are the only thing I care about.

But before we get to that evidence, let me just ask:

How would you know that things are positive enough to warrant getting back into the market?

Would it be because the news on TV is positive? Perhaps, but negative news attracts more attention than positive news, so you might not want to rely on this one because the news is bound to almost always have a negative bias.

Would it be because your friends, neighbors, family members, etc. are no longer panicking? Possibly, but that also would mean that some of the pain in the markets had already been alleviated. Pain alleviated = the market has already recovered some losses.

Or would it perhaps be because some kind of technical indicator highlights that it’s time to get back into the markets? This one is where the data starts to become useful.

Let’s look at Tactical Mutual Funds, for example.

(Tactical Funds are constantly measuring the proportion of stocks, bonds, & cash to try and dodge in and out of market declines and market rallies).

Below you can see that, as a group, funds that sought to enhance results by opportunistically shifting assets between stocks and fixed income underperformed balanced funds that simply held a relatively static mix.

Source Morningstar. Morningstar defines Tactical Allocation portfolios as those that “seek to provide capital appreciation and income by actively shifting allocations across investments. These portfolios have material shifts across equity regions and bond sectors on a frequent basis. To qualify for the tactical allocation category, the fund must have minimum exposures of 10% in bonds and 20% in equity. Next, the fund must historically demonstrate material shifts in sector or regional allocations either through a gradual shift over three years or through a series of material shifts on a quarterly basis. Within a three-year period, typically the average quarterly changes between equity regions and bond sectors exceeds 15% or the difference between the maximum and minimum exposure to a single equity region or bond sector exceeds 50%.”The funds above use a variety of tactics to try and gain a market timing advantage: algorithms, hunches, gut feelings, fundamentals, horoscopes, etc. They rarely outperform … But they do outperform sometimes, which is enough allure to continue to draw in outsiders. Resist that temptation.

If you need further evidence that tactical shifts in a portfolio can be very difficult to deploy with success, look no further than the struggles endured by the hedge fund community. Here’s an article.

The bottom line is this:

To trick yourself into not playing the “let’s wait until the news changes” game, just remember that there are roughly 20,000 kids who ace the SATs every year, many of whom go on to get Ivy League educations and eventual careers in finance. Those geniuses fail to routinely beat the market by forecasting how the news and data is going to evolve, so I would be weary to attempt something similar.

There will be no obvious signal that things are about to get better, but the markets have always recovered. If there was an obvious signal then everyone would start tracking that signal, so you’d then have to try and track the signal which occurs before the original signal. But then people would start tracking that signal and the cycle would just go on and on until you’d realize it was a lot of effort for no reason.

Trick Number Three:

Avoiding Risks Which Take You Out of the Game for Good

In the section above I said “markets have always recovered”, which is true. But markets are full of individual investments and individual investments fail all of the time.

Example:

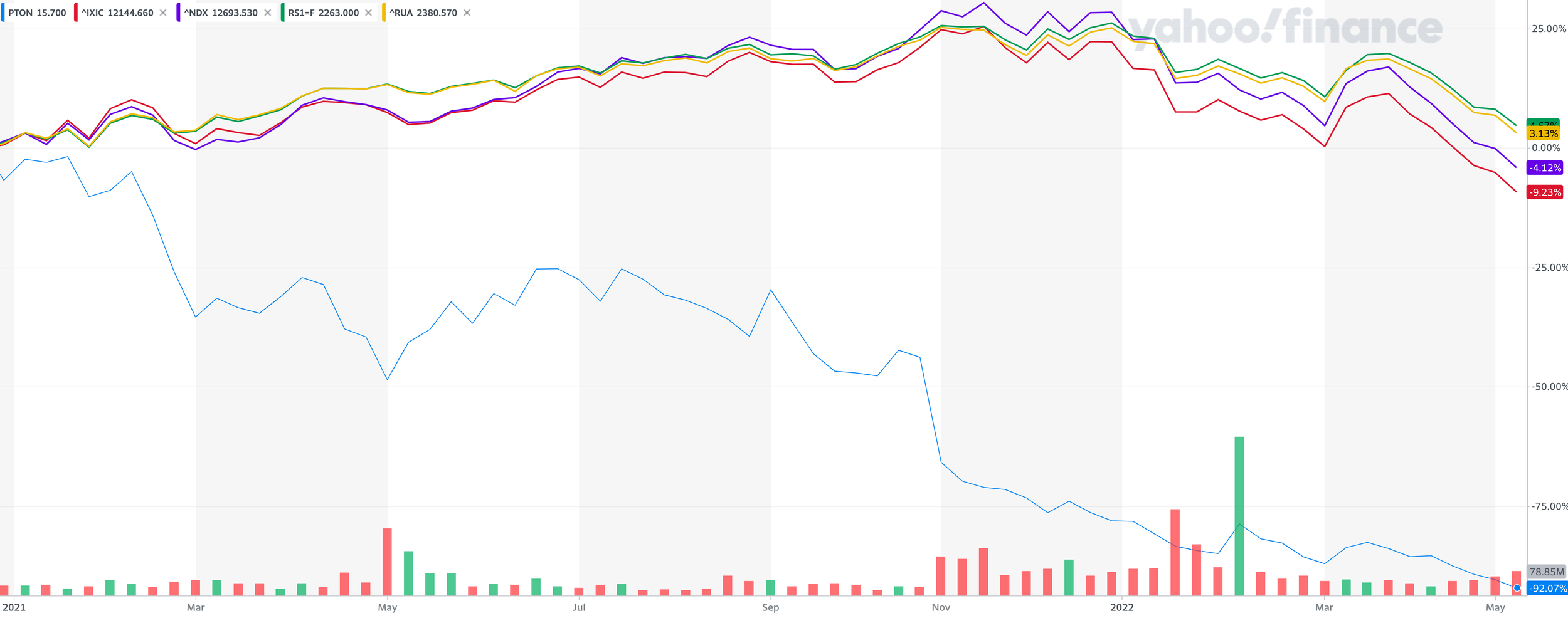

As of yesterday, May 10th, 2022, Peloton stock is down 92% from its all time high at the end of 2020 (12/24/2020). If you’d invested a hypothetical $100 in the stock at that time it would be worth about 8 bucks today. That 8 bucks would have to have a 1,250% rate of return going forward for you to get back to even with your initial $100 investment. That’s a tall order and there are a lot of examples of individual companies getting hammered in this current market environment. Simply put, a lot of stuff can happen to an individual stock, but far less can happen to an entire market comprised of individual stocks…

Peloton is just one stock but it maintains membership in several stock indices (i.e. “markets”). Some of them include:

Nasdaq 100

Russell 1000

Nasdaq Composite

Russell 3000

…here is a chart of the performance of those markets along with Peloton since it hit its all time high.

Source: Yahoo Finance. Past performance not indicative of future results.

What you can see above is the base argument for diversification. It helps protect against major swings — swings which can become extraordinarily difficult to recover from (1,250% ? no thanks).

Am I optimistic about markets? Absolutely.

Am I optimistic about individual stocks? Not always.

(the same can be said for niche strategies with big promises… like Cathie Wood’s ARK innovation ETF, which is down more than 60% YTD after she publicly forecasted 40% annualized expected returns for her strategy last December. Ouch.).

Of course, there is a lot of nuance to building a portfolio — the kinds of stocks owned, how many of them are in the portfolio, the tax implications of selling to buy something we’d usually rather own, etc…

When you consider your approach going forward, try to think about the future gain needed to offset a current loss…. A 20% decline only needs a subsequent 25% gain to get back to even, while a 50% decline needs a 100% gain, and a 75% decline needs a 400% return.

You can build optimism through diversification in pursuit of dialing back the aggressiveness of your strategy. The more you can mitigate steep losses, the more optimistic you can be about your ability to climb out.

Yes, past performance is not indicative of future results, but individual investments come and go, while markets have always recovered. I’ll end on that note.

Onward,

Adam Harding | Founder @ Harding Wealth | Advisor | Optimist |

www.hardingwealth.com

DISCLOSURESThe information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed to be reliable and we have reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorised reproduction or transmitting of this material is strictly prohibited. We accepts no responsibility for loss arising from the use of the information contained herein.RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.