Your Life In Weeks

I’ve seen this poster a few times. Check it out:

The idea of the poster above is that you fill in a square when each week passes. The weeks turn into months and the months turn into years.

I don’t know about you, but seeing an entire lifetime segmented into one week increments is kinda unsettling. But that’s reality.

If life seems relatively short when segmented this way, that’s because it is… especially if we zoom out a little bit.

Consider this:

If we used a single year (January through December) to contextualize the origin and evolution of our universe, with the universe beginning in January, the birth of Jesus would have occurred at about 11:59:56 pm on December 31st (so like 4 seconds ago). Columbus would have landed in America about 2.8 seconds later at 11:59:59.

Your lifespan in this cosmic calendar model of the universe would be about as long as a blink of an eye.

And with that, here’s the investing / financial planning angle of this writing.

As I’ve mentioned many times before, what matters is what drives money decisions. Ultimately, the pattern goes something like this:

1) We make a decision to invest based on what matters to us,

2) A week goes by and you get a weekly portfolio update from Harding Wealth showing your gain or loss that week (here’s a different blog I wrote on this weekly reporting) ,

3) We continue to revise our reasons for investing,

4) Make adjustments as necessary,

5) Repeat indefinitely.

Once again, the weeks lead to months and the months lead to years and years compile a lifetime. Considering each week on its own doesn’t paint a true picture, but stringing them together creates the mural… and in this mural, the impact of our investing decisions gets amplified over time. The reason is compounding of investment returns, personal decisions, and external factors (like a recession or something).

Take Warren Buffett, for example:

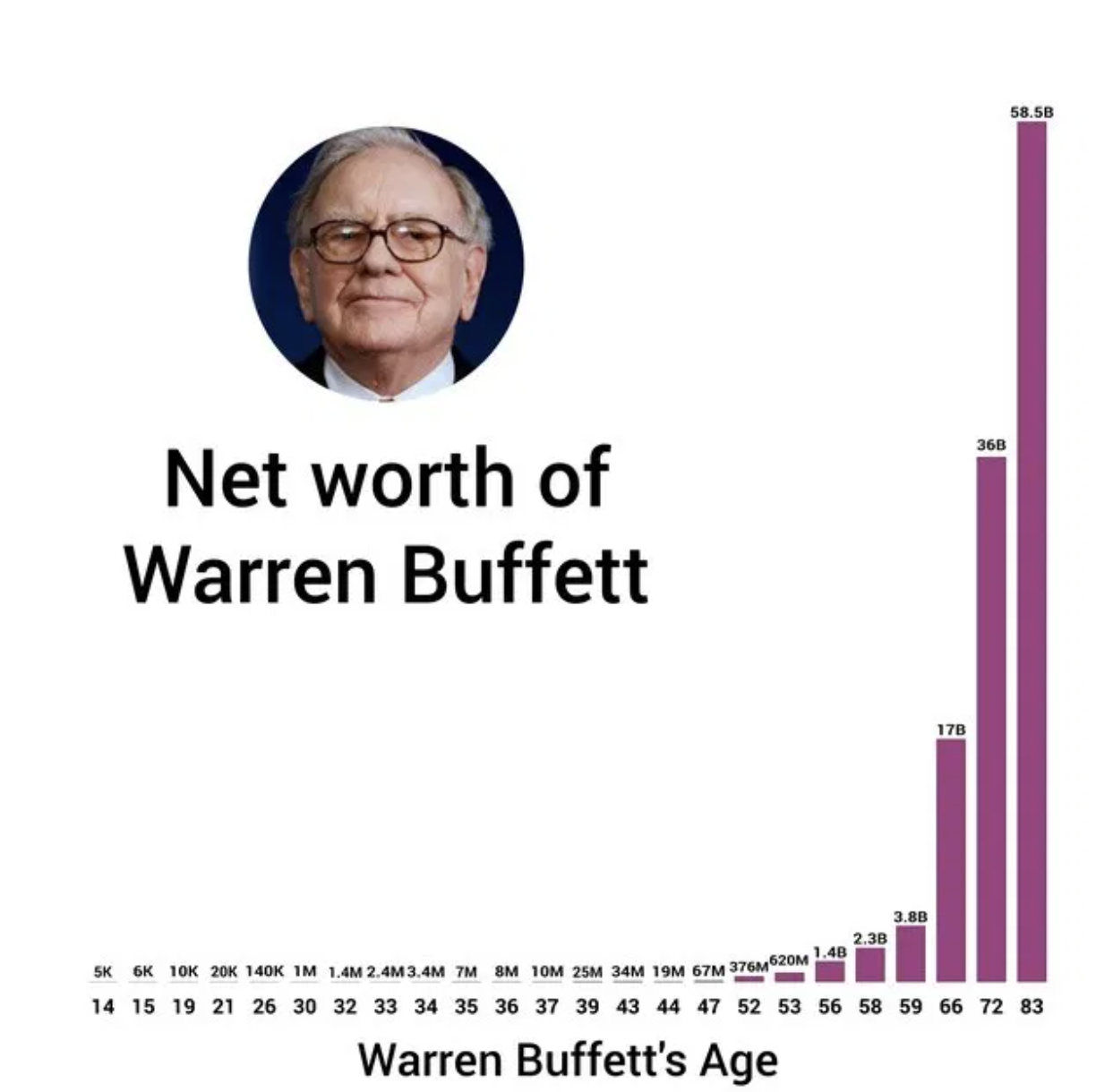

The net worth chart below is about 8 years old but it still tells the story I’m trying to convey (now Buffett’s net worth is an estimated $103 billion at age 91).

As you can see above, Buffett’s net worth over time has ballooned.

Worth noting is his net worth today at age 91 ($103B, not shown on the above chart) is more than 6x larger than it was at age 66 (i.e. close to the standard retirement age in the US). That’s a lot of wealth to accumulate later in life. The reason for this is due to a few factors:

1) Buffett has lived a pretty frugal life. He lives in the same house, eats McDonalds, and drives modest cars for a person with his net worth. Less spending = more investing.

2) As my favorite book on money (The Psychology of Money) accurately points out; “Buffett’s skill is investing, but his advantage is time.” …Most people don’t invest for this many decades. They also don’t continue working into their 70s, 80s, and 90s, allowing their assets to stay invested.

3) The portfolio size effect becomes much more dominant in later years when compounding returns have their biggest impact on a larger portfolio. When an investors sees growth on their initial savings plus growth on prior investment growth it can lead massive sums like Buffett has accumulated.

4) He never stopped investing even during a lifetime of crashes and rallies.

While I don’t work with any billionaires like Buffett, I can certainly attest to having seen investors grow their portfolios in a significant way even when they’re retired and simultaneously withdrawing funds from their portfolio. Their formula for doing this is similar to Buffett’s:

- Live a modest life relative to net worth

- Be flexible about when to retire and start taking money out of a portfolio.

- Continue to think like a long term investor even when they’re 70, 80, and 90 years old. You’re younger than you think you are, I promise.

- Stay disciplined through market cycles.

When people do this, I’m confident that the weeks can turn into years and decades which produce impressive outcomes.

Notice how none of the above factors have anything to do with a specific investment strategy. This is because behavior is much more important than tactics. Wall Street would convince you of the opposite because, frankly, they sell the opposite (i.e. “consider this hot stock to jumpstart your retirement!”).

In this format I rarely give advice (it’s imprudent to do so without knowing you better), but here is some I’m willing to stand behind:

Give yourself Buffett’s advantages of time + discipline, then pick a relatively boring strategy with a high likelihood of delivering over the long run, and then go live your life.

Speaking of living your life. Lately I’ve been reading a little more on the subject of mortality. Books like Being Mortal by Atul Gawande, When Breath Becomes Air by Paul Kalanithi, and a Comfort Crisis by Michael Easter have been great resources on the subject. I recommend each of them.

That’s all for now, be well.

Onward,

Adam Harding

Owner & Advisor @ Harding Wealth |

PS… I’m thinking of buying one of these Your Life in Weeks posters for myself. Should I buy them as a gift for clients? I’d love your feedback. Just send me an email and let me know.

Paul Kalanithi, neurosurgeon and late author of When Breath Becomes Air with his wife and newborn.

Image Source: https://www.thetimes.co.uk/article/when-breath-becomes-air-by-paul-kalanithi-gml8fgnmw