Time & Adaptation

Lower interest rates = a bunch of investments can survive despite questionable viability in their business models.

Higher interest rates = growth gets challenged and demand elasticity matters.

In challenging environments, some assets are better poised than others to survive — as an example, we need housing, we don’t need another unprofitable iteration of Doordash / Postmates / Uber Eats / etc…. (“Need” is another way to say “inelastic demand”). Even as 30 year mortgage rates have nearly doubled over the last 12 months, we still need shelter.

I called my dad this morning to ask if he remembered what the mortgage rate was on the first couple family homes we lived in growing up. I knew the purchases took place in the late 70s and early 80s — a period when 30 year mortgage rates were easily in double digits (10%+) — and I expected my dad to say something like “Oh, I remember, our mortgage rate was TWELVE PERCENT!!!” or something like that. Instead, he barely remembered what the rate was.

How could someone not vividly remember a huge number like that? Two reasons:

1) The passage of time tends to dilute the potency of even the most remarkable situations, and

2) People just manage the circumstances they’re faced with and tend to get by.

Let’s explore each of these…. First up, time and potency.

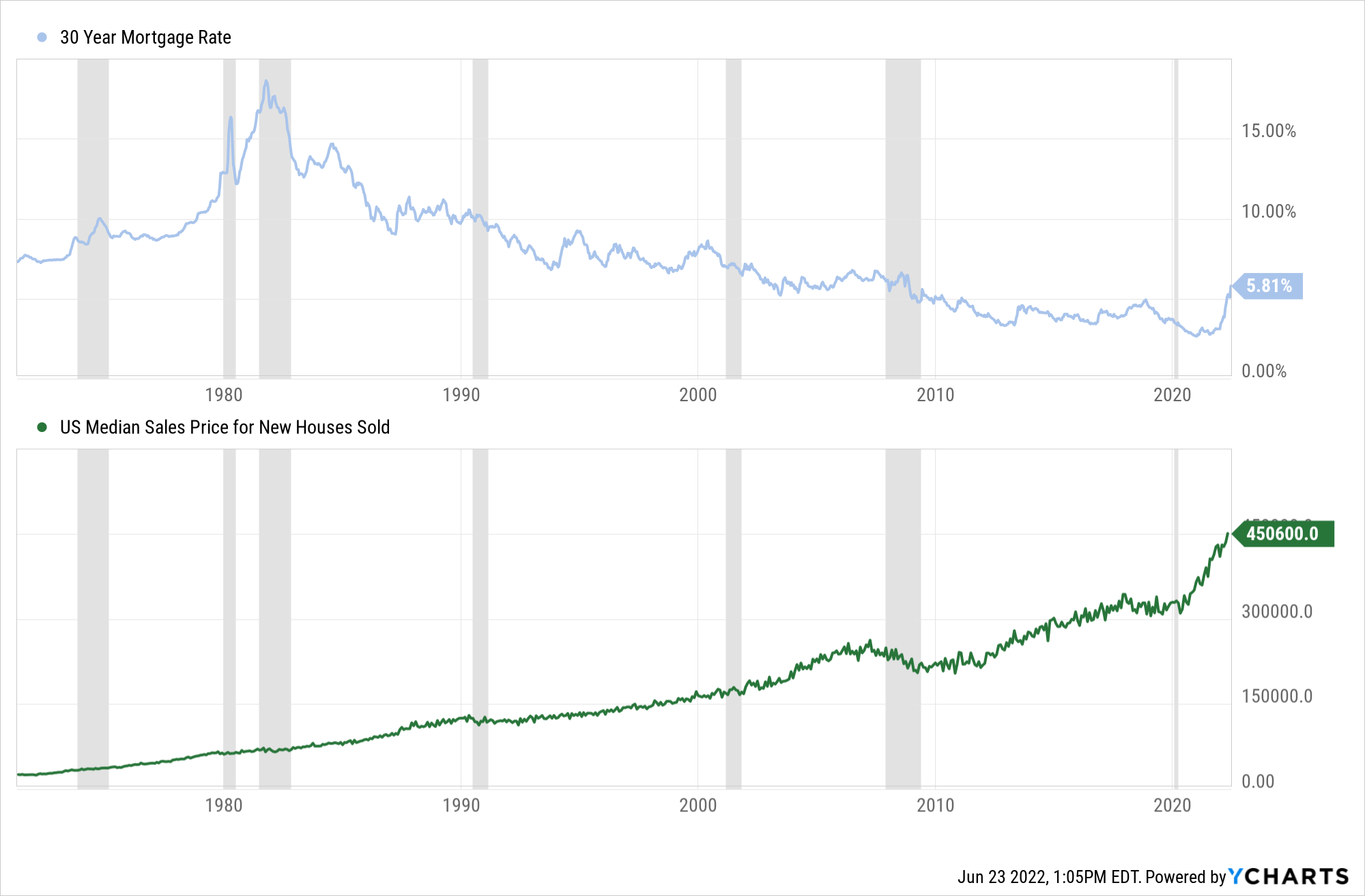

Consider the chart below which compares 30 year mortgage rates (top) and median sales price for new houses sold (bottom).

(Areas shaded in gray show recessions).

Look at those mortgage rates in the 80s! Wow.

Now look at the median home price movements during that same period in the 80s. Not so remarkable, right?

What this chart doesn’t show is a 9.5% drop in median sales price for new homes from August 1981 to February 1982 as a result of spiking mortgage rates and a recession…I mean, the drop is there but it’s not easily seen because time has caused even a 9.5% drop in prices to be relatively insignificant.

Time nullified those challenges because the assets were resilient.

Adapting to Circumstances.

My dad couldn’t remember what his mortgage rate was, but he did recall buying treasuries which had some pretty attractive yields during this time.

Here’s the historical yield on 2 Year Treasuries:

Look at that huge spike in the 80s…. Imagine getting upwards of 15% yield on a 2 year bond (we’ve haven’t seen double digits since the late 80s). Getting attractive returns in other areas certainly made high mortgage rates seem more palatable.

Perhaps more generally, it shows that a negative situation on one side of the financial spectrum (housing prices falling and borrowing costs rising) led to an opportunity on another side of the spectrum (high yields on treasury securities).

People just adapt. You will adapt to whatever’s coming too.

Speaking of Adapting… A quick personal note.

Last week my wife and I sold our first house.

A house where we learned a lot of lessons and lived a lot of life.

A house we bought a few months before we were married. After draining my bank account to buy an engagement ring a couple months prior, we depleted the remainder of our bank accounts to buy this place.

We made best friends at that house.

We got married down the street at the Desert Botanical Garden.

I started this firm from a laptop in the office of that house.

We turned the office into a baby room and brought Clay home there. He crawled and took his first steps in those hallways.

We quarantined there and turned our guest bedroom back into an office to help manage life in 2020.

They knew Clay’s smoothie order at the Dutch Brothers on the corner. His scooter is covered in stickers from our walks to “the smoothie place.”

Our Adele was born there, delivered by yours truly (the address is listed on her birth certificate where the name of a hospital typically is)… With her arrival we started to outgrow the house.

_______

When it comes to investments for myself or for our clients, I don’t get emotionally attached to a specific strategy or tool — we only care about the pursuit of an outcome, a goal or objective. But there is also a lot of overlap between life and money, and (if you’re lucky) sometimes it’s emotional.

You still evaluate the role of assets in the scheme of a bigger plan, but sometimes it’s about more than just mortgage rates, median home prices, and treasury yields. Sometimes you give up a place where memories were made so you can make way for a new place where new memories can be made. The sadness and excitement of change is a gift we’re lucky to have received.

Out with the old, in with the new.

Onward,

Adam Harding | CFP | Owner & Advisor at Harding Wealth

[Photos left to right: (1) My wife and I the day we bought the house. (2) My son in his empty room after moving out. (3) My daughter in the same spot she was born. (4) The whole family upon moving out.]