The Battle for Your Cash

In the last 24 hours I’ve had two distinctly different discussions with clients about cash management.

Discussion #1:

Client: “Okay Adam, I’m finally ready to move my excess cash from the bank to invest in money market, CDs, etc. to get better returns".”

Me: “Sounds good. I know we talked about this before and you didn’t move the funds at that time — what prompted the sudden change of heart?”

Client: “I just looked at my April statement and I’ve made $9 YTD on $220,000 in cash!”

…

Yikes. $9 through four months is not good. (Don’t worry, we moved her cash to her brokerage account to target higher yields).

Discussion #2:

Client: “Adam, I see that my credit union is paying 5.25% on cash. This looks to be higher than the money market rate I’m getting. Should I do this?”

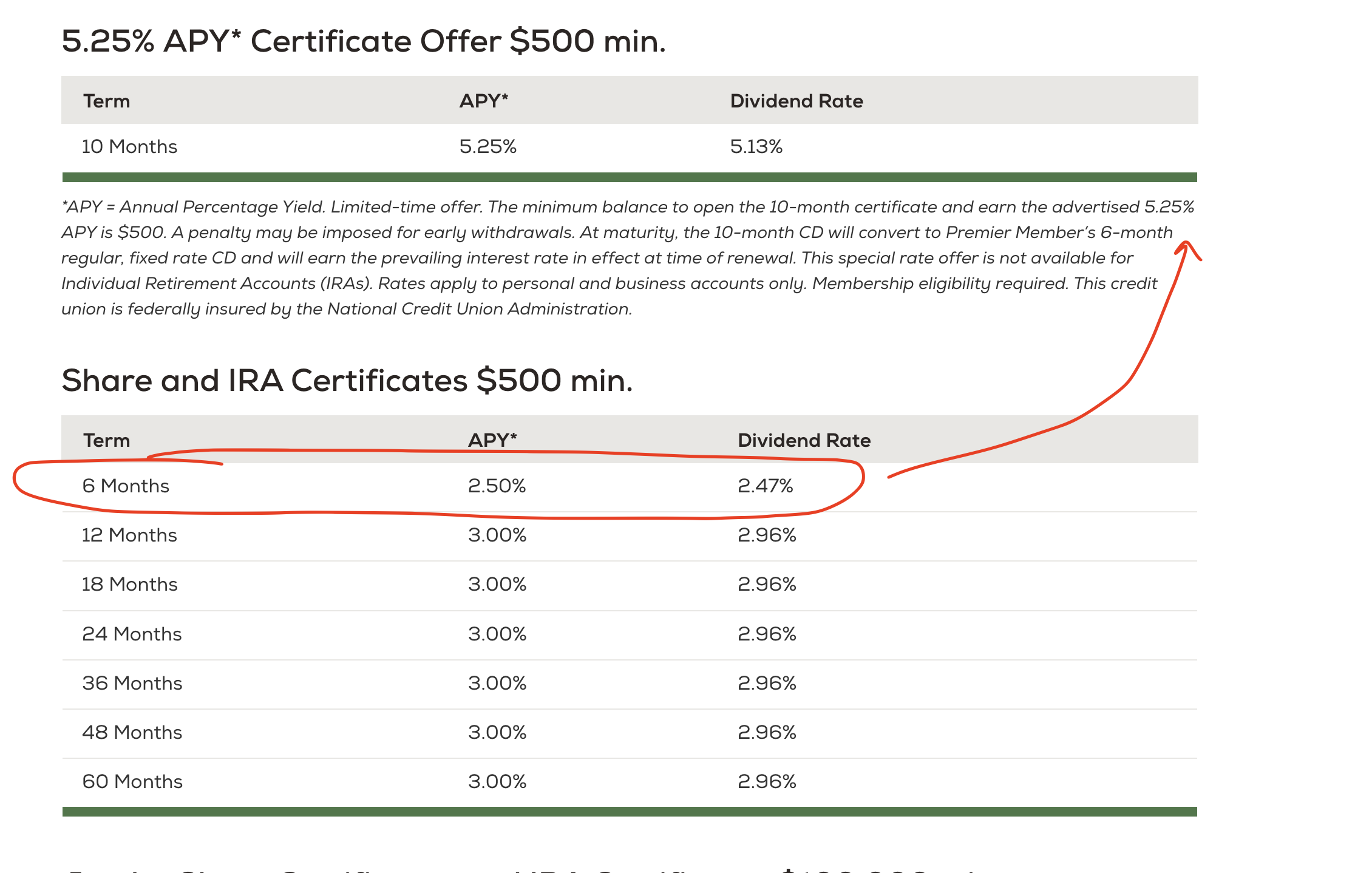

Me: “Great question. I’ve included an image below from their website (link) which shows that the 5.25% APR is for only 10 months, at which point your CD would convert over to a 6 month CD (which currently pays 2.5%).

These are tricks which financial institutions use to get people to open accounts, buy the 5.25% thing and then not want to go through the hassle of switching again (or forget to switch altogether).

I like the approach we already have at Charles Schwab.”

Each of these exchanges highlights perhaps the most significant trend happening in economy today. That trend: The Battle for your Cash.

Let’s talk about it.

You see, earlier this week The FOMC raised the Federal Funds Rate another .25% to land at 5.25% at the apex of the fastest rise in short term yields ever.

Here is the last 30 years of Federal Funds Rate activity:

The last time we saw these kinds of rates was back in 2006-2007 when the Fed was late to act and left scrambling to manage a housing boom (which, like this crisis, arose out of mismanaged policy — like the ‘liar loans’ to banks were allowed to issue as a result of the Community Reinvestment Act).

When the Fed hikes rates like this it has a ripple effect; savings accounts, money market, CDs, Treasuries, etc. each start paying higher yields, but some are quicker to respond than others (checking/savings is almost always last to respond).

With all of this going on, How to Manage Cash seems to be the hot topic in finance.

I’m sure you’re getting a lot of competition for your cash and it’s hard to know what to do. To help with this, here are 5 considerations I think are worth remembering:

Always hold some low or zero yield cash (your checking or savings accounts).

This cash won’t give you much return at all, but that’s okay. It’s there to pay the bills and to be immediately available if something comes up.

Your cash can be an investment for you or for the bank. Choose wisely.

Your bank is using your cash to make money for themselves through offering loans or investing. The more they pay you, the less they make… Remember that as your balance in the zero yield cash accounts grows.

Park your larger cash balances in something with more yield.

This would be for your emergency fund or any large excess cash balances you’re holding for any reason (like a big purchase coming up or just because you like to hold a lot of cash).

We tend to encourage clients to hold as few financial accounts as possible (fewer things to think about, fewer tax forms, etc.), so we’ll often advise investors to park their larger cash within taxable brokerage accounts they already have (Individual, Joint, or Trust accounts) alongside their other investments. Within that brokerage account you can buy money market funds, treasuries, CDs, etc.Establish a money link between your brokerage account and bank accounts.

Pursuing more yield with your excess cash often comes with a cost: slightly less liquidity.

As an example, let’s say you move your excess cash to your brokerage account and buy a high yield money market fund. If you needed to convert the fund back to cash so you could buy something, here’s how it would go:

Day 1: Sell the money market mutual fund.

Day 2: Transfer the funds to your bank.

Day 3 (or maybe Day 4, depending on your bank): Funds are settled and you can spend them.

We think the added interest is worth not having immediate access to your money — if you have your bank linked to your investment accounts it’s about 3 days before you can spend the money. You can decide for yourself if you think it’s worth it.

Forget about inflation.

People will often say things like “I just want my investments to beat inflation.” This is a reasonable request, but it’s kind of unfair. Let me explain

Today, inflation (CPI) is about 5%. Meanwhile, the yield on a sample government bond money market fund (SNOXX, in this case) is currently 4.5%. Some may point out that this means you’re losing .5% in real returns (purchasing power) after accounting for inflation. While this may be somewhat accurate, I want you to remember what this cash actually is: excess cash.

If you want a better chance at beating inflation you’re going to have to do one or more of the following:

Lock up your investment for a longer amount of time. Longer term CDs, bonds, etc. pay more than short term bonds.

Park your cash in a less creditworthy product. If you loan your money to someone who is less likely to pay it back, you might have a better shot to beat inflation.

Abandon safety altogether and buy stocks. After all, the stock market has historically been a solid inflation hedge.

When we look at the three things above, I see nothing but sacrifices: sacrificing liquidity by locking up your funds for longer periods, sacrificing safety by loaning your money to less creditworthy borrowers, and sacrificing peace of mind by having your money invested in the stock market. There’s a time and a place for investing this way, but this is just about getting a little extra yield out of your excess cash; it’s not about beating inflation — let the aggressive investments in the rest of your portfolio handle that task.

The Bottom Line

We haven’t seen attractive yields like this on short term, safe investments since 2006-2007, so you should almost certainly be taking advantage of them. That said, don’t overcomplicate your financial life and don’t waste too much energy trying to squeeze every 1/100th of a percent of return out of your portfolio. Just park your cash in a safe, sensible, and easy to access account which generates a reasonable yield for the climate we’re in.

Of course, if you have any questions about cash or anything else, email or call anytime.

Onward,

Adam Harding

CFP | Advisor & Owner @ Harding Wealth

www.hardingwealth.com