Building a Playbook for Stuff That’s Never Happened

“Things that have never happened before happen all the time.”

―Morgan Housel, The Psychology of Money

I’m not going to sugar coat it, things are pretty challenging right now: highest inflation figure in more than 4 decades, war in Europe for the first time since WW2, and a supply chain that is scarily dependent on volatile foreign actors for some of our key domestic needs.

Lately I’ve been trying to find the words to give investors, clients, friends, family, etc. comfort in the face of today’s irreducible uncertainty. Despite there being no single formula, I’ll try my best.

But first, a lesson from Ukraine President Volodymyr Zelensky:

During his 2019 inaugural address, Zelensky (now famously) addressed his fellow government officials by saying “I do not want my picture in your offices: the President is not an icon, an idol or a portrait. Hang your kids' photos instead, and look at them each time you are making a decision.”

(apparently many government officials have Presidents’ portraits in their offices in governments around the world)

This is good advice: make decisions with the things you care about in mind and it will heighten the quality of the decision and, in turn, improve the likelihood of reaching the intended outcome.

This also happens to be very good investment advice.

When faced with decisions with your money, remember what you’re investing for in the first place. This could be retirement, children/grandchildren, a vacation home, to sleep well at night, to outpace inflation, to buy an airplane, etc.

That thing you’re investing for should help you arrive at a timeline for investing. Retirement might be 10 years away, Building a Large Estate to Leave to Children and Grandchildren might be 30 years away, etc.

When you know why you’re investing and about how long you can leave your money invested, you’re able to zoom out and not focus as much on the short term challenges in the markets. Of course, everyone is different, but if you must, find some kind of visual representation of your intentions and make it the screensaver on your phone or computer, or print it out and stick it on your desk. It will help.

The Power of Zooming Out

When in doubt, zoom out. Here’s a chart:

The last 15 years have been eventful and markets have been resilient over the long term, many people know that.

Here’s another chart:

Every bump in the road in the chart above had investors thinking I should have gotten out before that happened! or I knew a crash was coming! … These are normal feelings to have, but it’s risky to act on them the next time we think there’s a pending crisis.

Traffic example:

Do you find yourself driving and have another person zoom around you changing lanes, then weave around another car, then another and another, but then you and that driver both get stopped at the next traffic light only to realize all of that weaving around traffic got them basically nowhere compared to just sticking in one lane?

That’s a little like trying to weave in and out of the market: takes a lot of effort, adds risk of an accident, and often doesn’t get you anywhere faster. Even further, it might actually cause you to miss out.

Here are some of the implications of missing out on the best days for the stock market:

The graphic above highlights how risky it can be to get in and out of the market frequently. Over the last 15 years there have been many reasons to want to avoid market risk (i.e. sell stocks and hold cash), but that also presents a risk of missing the best days in the market. Nothing is harder to do than make accurate short term forecasts which miss market drops but participate in market rallies.

But what if there was a reliable way to get out before crashes and back in before rallies? Wouldn’t that be great!?!

Before I answer that, who recognizes this photo?

The above is a picture of The Hindenburg as it crashed in 1937.

The Hindenburg Omen (named after the famous zeppelin above) rose to fame in 2010 as a technical signal of a pending dramatic decline in stocks. The Omen occurred only when multiple measures of 52-week high/low prices and moving averages all turned negative — and it had correctly foreshadowed major downturns in 1987 and 2008. So when it flashed a “sell” signal on Thursday, August 12, 2010, traders were buzzing the next day with talk of a looming crash….But no crash occurred, and the S&P 500 had its highest September return since 1939.

People are always looking for a consistent competitive edge.

The money management industry as a whole is highly competitive, with more stock mutual funds and ETFs available in the US than listed stocks, so if someone could develop a profitable market timing strategy, we would expect to see some mutual funds or ETFs employing it with successful results — and if those successful results became public, then the copycats would arise and there would be more successful market timing operations.

However, a recent Morningstar report suggests investors should be wary of those managers claiming to do so. The report examined the results of two types of funds, each holding a mix of stocks and bonds:

Balanced Funds: Minimal change in allocation to stocks

Tactical Asset Allocation Funds: Periodic shifts in allocation to stocks (i.e. market timing)

As a group, funds that sought to enhance results by opportunistically shifting assets between stocks and fixed income underperformed funds that simply held a relatively static mix. Morningstar further pointed out that if the performance of non-surviving tactical funds (i.e. funds that had shut down over this time frame) were included, the numbers would be even worse. Its conclusion: “The failure of tactical asset allocation funds suggests investors should not only stay away from funds that follow tactical strategies, but they should also avoid making short-term shifts between asset classes in their own portfolios.”

Simply put, I’ve sat at the table with intelligent money managers whose entire focus is beating the market through market timing and tactical allocation… This is a difficult game to play over the long run. It’s not impossible to win and I know a few people who have done this successfully (a client of HW is quite good at it, actually), but the odds of market timing successfully and consistently just aren’t good.

Okay, let’s move on. How do markets typically fare in times of geopolitical stress?

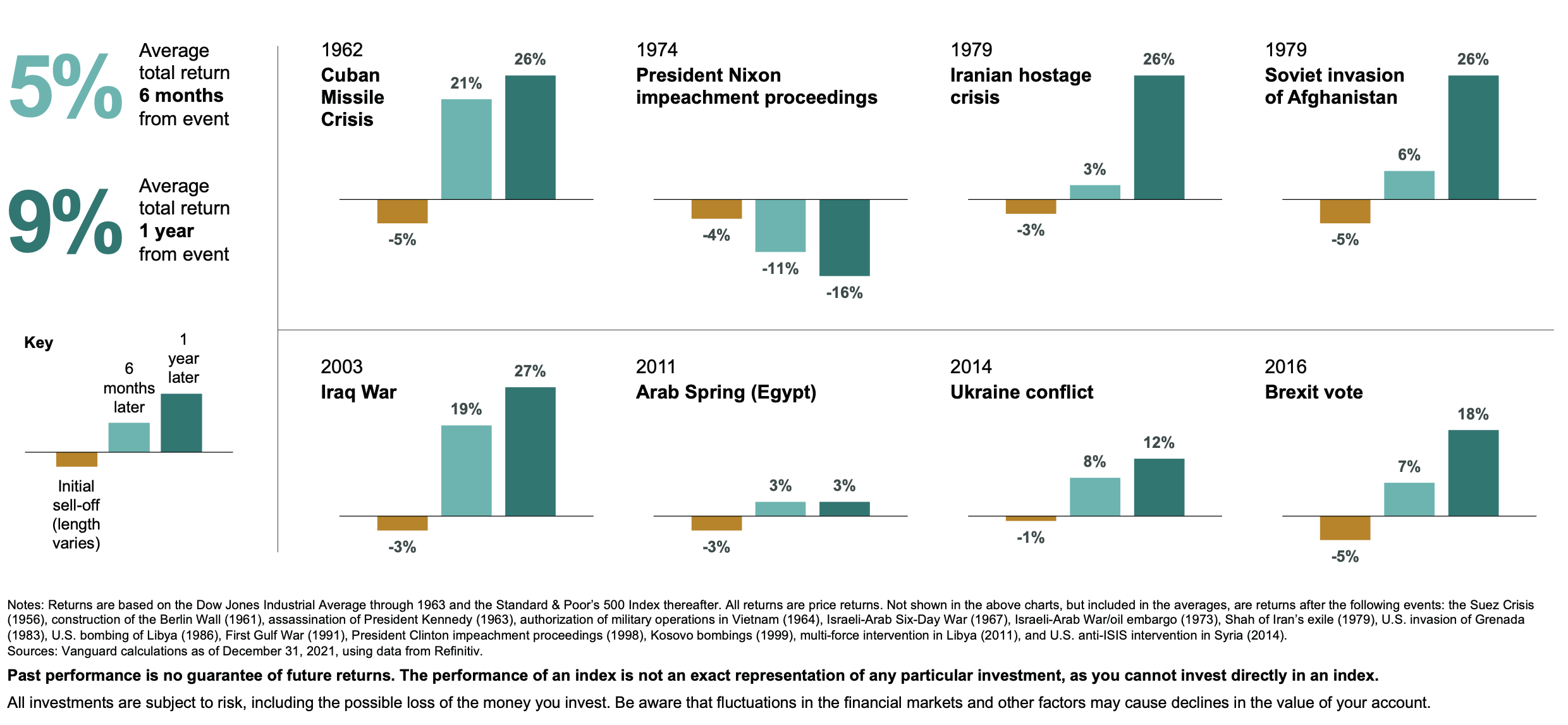

The geopolitical crisis in Europe is now top-of-mind for many investors. Let’s take a look at some historical periods of heightened geopolitical tensions.

Below is a graphic from Vanguard which shows the stock market (S&P 500) return during the crisis period, 6 months post-crisis, and 1 year post-crisis.

The situations above were, by and large, bad for investors while they were happening but generally okay after some time had passed. Who knows what will happen as a result of this situation, but the chaos of those prior environments must’ve felt just as uneasy as things feel today.

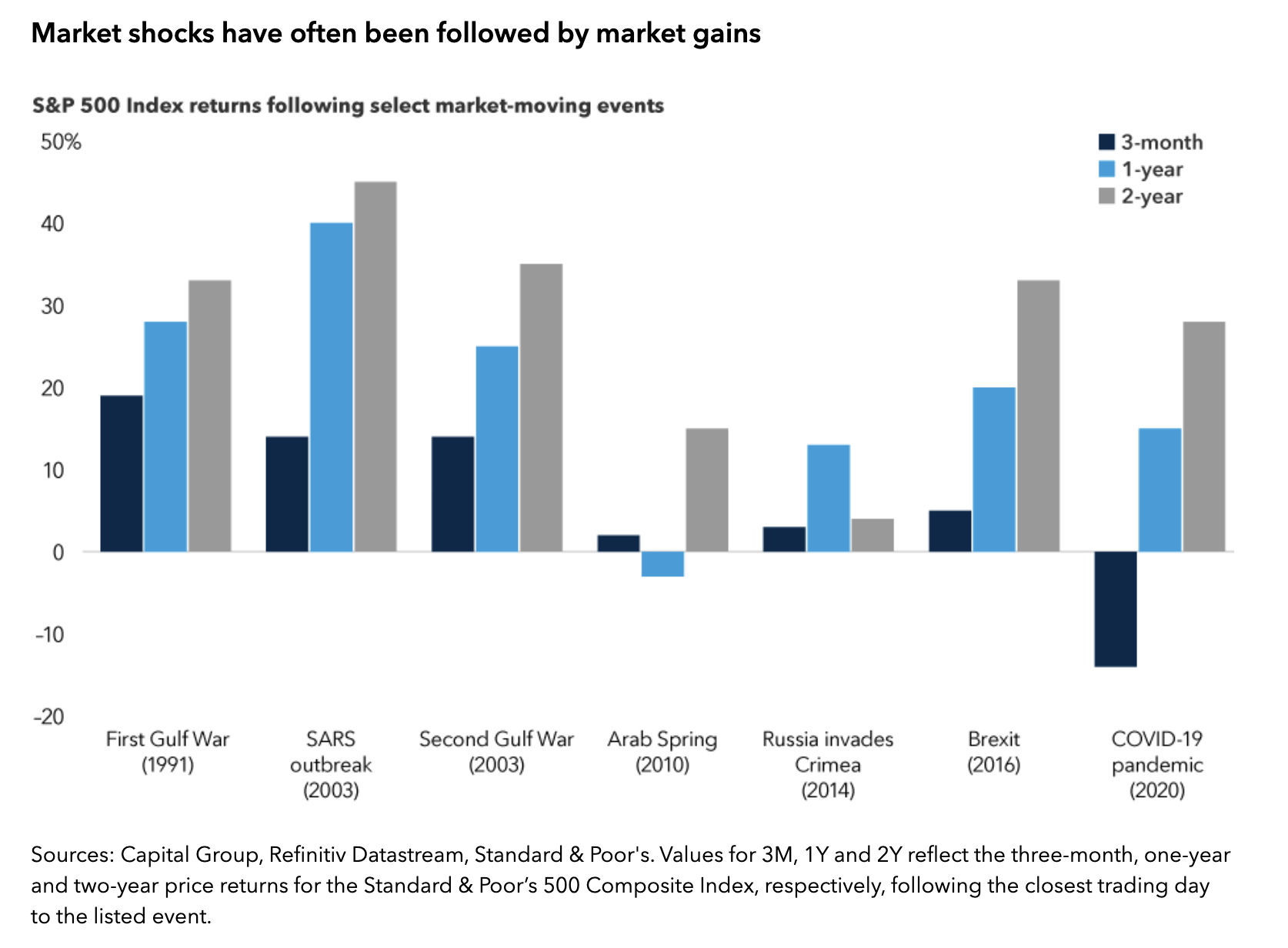

Here is another graph highlighting stock market behavior around the time of major societal events.

Long Story Short

In the absence of a definitive playbook for investing in the current climate, we have two choices:

1) Stick to our plan we developed when things were calm and we were thinking clearly, or

2) Abandon that plan and do something new.

Clearly I’m a bigger fan of sticking with our plan unless something in your life has changed, but I would encourage every investor to remember that your financial plan should have planned on your plan not going according to plan.

This is one of those moments where things haven’t gone as planned.

Yet I have not spoken to a single investor whose goals are in jeopardy. Instead, the majority of clients I work with have understood that a single week, month, or year doesn’t dictate their life over the long term. Our clients decide to look at the photos of loved ones on their wall or desk, plan the next family get-together, say their blessings that they’ve gotten lucky with the ‘birthplace lottery’ by being born in the US, and go on focusing on what matters to them…. Our clients also realize that scary markets happen and that we’re here to stand shoulder-to-shoulder with them, even in the absence of a definitive playbook for a thing that’s never happened.

Stuff that’s never happened before happens all the time and the things we believed about investing through past things that had never happened are true today. I can’t see any reason to change course now.

As always, if you need someone to talk to about this or anything else, that’s what we’re here for. Just schedule a meeting or shoot me an email.

Until then, onward.

Adam Harding | Advisor | Owner @ Harding Wealth

480-205-1743

adam@hardingwealth.com

Past performance is not indicative of future results. Not investment advice. Please consult a financial advisor and give your loved ones a hug before making decisions with your money.