Defining Moments

Let's pretend for a minute that it's the year 2025...

You’re looking back at the CoronaCrash of 2020, the massive losses it dealt to your portfolio and how you reacted as an investor.

Just as we reflect on prior crashes, our accounting of what happened will contain phrases like “Of course ______ happened…” or “Clearly it was going to be a big deal...” or “Everybody knew that…”

In your brain, the crash of 2020 won’t be an accurate recollection of what it seemed at the time, because right now it seems irreducibly scary and uncertain. Time will pass, certainty will be given, and our fears will subside. That's how it works.

In 2025 I'll be advising clients, some of them old and some of them new and during discussions we will reflect back on what decisions were made right now.

Did we completely sell at a 30% loss?

Did we buy?

How close were we to the bottom when we bought?

When we sold with the intent to get back in, how much of the rebound did we miss?

... When meeting new potential clients I often ask about their experience through the Financial Crisis and, more recently, the 20% decline in late 2018. What did they do? How did they feel? Etc. But from here on out, this current crisis will be the defining moment for all of us.

Everyone agrees that 2009 or 2010 would have been the best time to buy stocks in a generation, but very few investors actually did.

Why is that?

...Take your pulse right now after watching the news for a few minutes.... THAT'S WHY.

It's scary.

Now I'm not saying that this is the bottom of this market or that you should rush out and buy stocks right now --after all, this crash has been the most unpredictable, rapid and unprecedented decline by almost every modern metric. But we should acknowledge the above and try to determine where we fit into history.

Over the course of the last month I've presented a lot of data and charts and encouragement that this will get better eventually. In fact, my own confirmation bias has me seeking out third-party research and opinions to support this belief. I see the negative stuff too, but I refuse to give in to fear.

To be clear, my opinions and theses are optimistic in nature.

I believe things will be okay.

I believe the ensuing rebound will be prolific.

I believe good things can come from crises.

I have to keep this disposition because (1) it would have been the right attitude to have in every prior decline and (2) there is very little good news these days and I'm doing my part fo balance things out.

My conversations over the last couple weeks have ranged from clients saying,

"How can I save and invest more while prices are low."

to

"Halt all future investments and turn my portfolio into cash."

These responses --and any in-between-- are all perfectly normal and human and justified.

If you're panicking, that's okay.

If you're scared, that's okay.

If you're mad, that's okay (even if you're mad at me, I can take it).

If you're optimistic, that's okay too.

I'm not here to tell you how to feel, but to try and be a sort of "release valve" during a crisis situation. If it were solely up to me we'd stay the course, use excess cash to buy into the hardest hit part of our portfolios, and continue making moves to optimize your tax situation (tax loss harvesting, roth conversions).

Usually we can help to decompress the situation if we just talk and remind ourselves of our investing principles and why we are invested the way we are.

For the record, no traditional investment strategy has been spared from this decline (aside from the US Dollar, of course), but right about now is when we may start to hear about the super-rare strategies that profited during a crash like this one (much like The Big Short in 2008)... and for every winning strategy like that, there are many losers. No one can identify the winners in advance.

The "experts" are rarely right consistently.... Mutual funds are a great example of this:

As a refresher, a mutual fund can hold many or not-so-many stocks, bonds, cash, REITs, futures, options, etc... Just like any individual or hedge fund could adopt a strategy to make big adjustments in anticipation of major events like those we're seeing now.

Unlike hedge-funds, mutual funds must be ultra-transparent, so we can use the data they provide to draw insights about market timing, stockpicking, building large strategic cash reserves, etc.

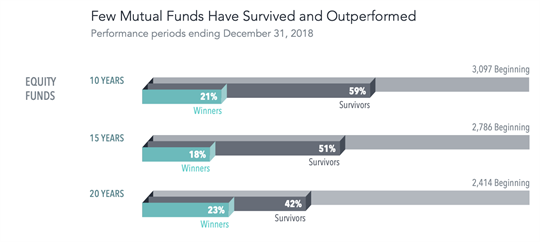

Let's take a look at how many mutual funds have outperformed their benchmark indices over the last 10, 15, and 20 years:

As you can see, over the last 20 years only 23% of mutual funds beat their low-cost passive benchmark index. This poor track record exists despite having significant resources and staff to commit to research.... Think of the CFAs, MBAs, PhDs, etc. on these analyst teams.

The above data doesn't include 2019 or the current crisis, but it does include the Tech Bubble (2000-2002), September 11, 2001, and the Financial Crisis (2007-2009).

Hedge fund data is less clear, but as of a week ago, Ray Dalio's Global Macro Fund "Pure Alpha" was down 20% (link). Dalio's strategy famously made 9.5% in 2008 when the financial crisis ensued. He also posted a -0.5% loss in 2019 when the markets were roaring. People pay this firm huge fees to predict the future and it just hasn't happened.

(Ray Dalio is the head of Bridgewater and is perhaps the most notorious and well-respected hedge fund manager in the world)

Even the Oracle of Omaha hasn't been immune...Warren Buffett's Berkshire Hathaway (BRK.B) is down about 25% YTD despite sitting on a massive cash reserve. (link)

... Speaking of Buffett, remember his bet with the hedge fund community? He bet Protege Partners that a basket of hedge funds couldn't beat the S&P 500 over 10 years from 2008-2017. It wasn't even close...The hedge funds got crushed. (link)

These are just a few examples among countless stories of strategies --and strategists-- being unable to execute their big plans to prevent or exploit short term downturns.

So while I can appreciate that somestrategies are able to win in challenging environments, they often do so at the expense of winning when things are good. Also, there's no certainty that they will perform as expected when things get bad. It's a gamble, not an investment.

With every single investor I consult, we arrive at the following general principles for investing:

1) Stocks Tend to Outperform Bond Over Time

2) Bonds Tend to Outperform Cash Over Time

3) Market Timing Sounds Nice But Is Impossible to Implement Consistently Over Time

4) Active Investment Strategies Underperform Less Active, Lower Cost Strategies Over Time

In each of the above cases, I emphasize "over time" rather than saying "all the time"...Nothing outperforms all the time.

If something outperformed all the time then everyone would just go buy THAT thing and the excess returns that investment had previously enjoyed would have to be split between way more buyers and ultimately become diluted and making it no longer the thing with consistently the best return.

I'll leave you with this:

If you could magically wake up 5, 10, or 15 years from now, what would you think about your decisions made in February and March 2020?

Looking back at the financial meltdown of 2008-09, would it have been a good idea to buy stocks after a 30% decline even though the bottom occurred at about a 53% total drop? As time has passed, the answer is of course.

We have no way of knowing when this will end. But we have our patience. We have our resolve. We have hope.... and yes, we have history.

Some people think I should abandon history, I think we must honor the past and help write the future with the decisions we make today.

Adam Harding, CFP