It’s not the Monkey, it’s the Dartboard.

One of my favorite investing books is “A Random Walk Down Wall Street” by Burton Malkiel.

In it, Malkiel argues that if the stock market is truly efficient (meaning that current share prices reflect all factors immediately as soon as they're made public), a blindfolded monkey throwing darts at a newspaper stock listing should do as well as any investment professional who is trying to pick stocks to beat the market.

Think about that.

A monkey with no skill, deploying pure randomness is potentially better than a premium, high cost professional with loads of experience and resources at their disposal? Wow.

I get it though. After all, we know how active stockpicking mutual funds have performed when they’re tasked with trying to outguess the market. See below:

Source: Dimensional. Mutual Fund Landscape 2022.

The above shows how difficult it can be to consistently outperform (“Win”) over long periods of time when your approach is to outguess the overall market.

And, while hedge fund industry data is a bit more opaque than mutual fund industry data, there are some reports that hedge funds down as much as 15% through September 2022 despite their hefty fees and perceived exclusivity.

So, yes, it’s hard to beat the market even with teams of math wizards and economics geniuses.

But what about this monkey? Why might they have a decent shot at it?

It’s not the monkey, it’s the dartboard.

Here’s what a traditional dartboard looks like:

The main characteristic of this dartboard is the equal size of each number and the equal probability of a random throw hitting each space.

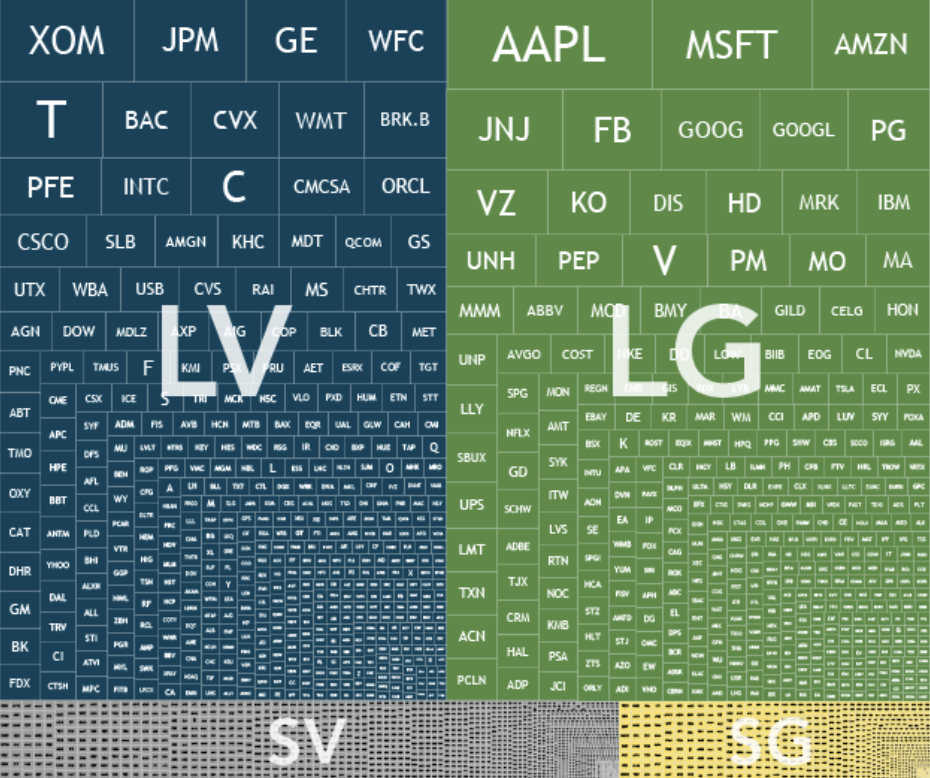

Now let’s think about the US stock market as a dartboard. When stock picking humans are trying to find opportunities, the dartboard in their minds may look a little like this:

Source: November 10, 2022. Past performance not indicative of future performance.

If you’re a normal person you’re always going to pay a bit more attention to Apple (AAPL) than you would Steel Dynamics Inc. (STLD) or any other small cap firm which isn’t a big enough company to show up on this chart.

However, when investing, there just happens to be something called “The Size Premium”, which basically outlines that, over the long term, smaller stocks have tended to outperform larger ones.

Of course, nothing always works and past performance is not indicative of future performance, but in this case, a dartboard which looks like the above would have a disproportionate likelihood of a larger stock being picked.

Yet, our monkey (who I’m now going to name “Bananas”) is throwing darts at a newspaper with stocks listed. Remember this page in the back section of your paper?

As you can see, each stock is given the same amount of space, so the likelihood of Bananas hitting a small stock is equal to that of him hitting the biggest ones.

But there’s also something else going on with these dartboards. Something tied to the “Value Premium” which suggests value stocks may outperform growth stocks over time. The stock market consists of Large Value stocks, Large Growth Stocks, Small Value Stocks and Small Growth stocks (and mid cap and microcap stocks, but let’s not get too specific while I’m making this point).

Once again, nothing always outperforms, but it’s worth looking at how a human’s dart board might look when compared to Mr. Bananas’.

Human Dartboard:

*As of Dec 2016. Cap weighted.

Monkey (Bananas’) Dartboard:

*As of Dec 2016. Equal weighted.

As you can see above, when every stock is given the same amount of real estate on the dartboard, there is a much greater likelihood that a small value (“SV”) stock will be selected…

…This is why I like the monkey’s chances relative to the humans. The monkey is actually harnessing the Fama-French Three Factor model for stock selection. Nice work, Bananas.

With all of that said, my main problem with using the monkey’s strategy is lack of diversification. We need Bananas to throw another couple hundred darts and to figure out a way to highlight profitability and global diversification into his stock selection — but he’s on the right track.

That’s all for today, happy throwing.

Onward,

Adam Harding | CFP | Smartvestor Pro

www.hardingwealth.com

Schedule a Call