Costco Gold

There I was, minding my own business in Costco, buying more avocados than my family can consume, pondering on what day I would need to turn them into guacamole so they don’t go bad, when the guy behind me caught my attention. He was talking about buying gold at Costco.

If you haven’t heard, Costco sells physical gold. And they are MOVING those gold bars, to the tune of ~$200 million sold each month. Your local Costco may carry the gold bars, but most are sold online. Costco sells these gold bars for about a 2% premium to the current gold spot price, but buyers are allowed to use their Costco credit card to buy them, which gives cash back of about 2% on Costco purchases, making the spread a near break even.

As of April 9th, you could buy a 1oz gold bar from Costco for approximately $2,359.99

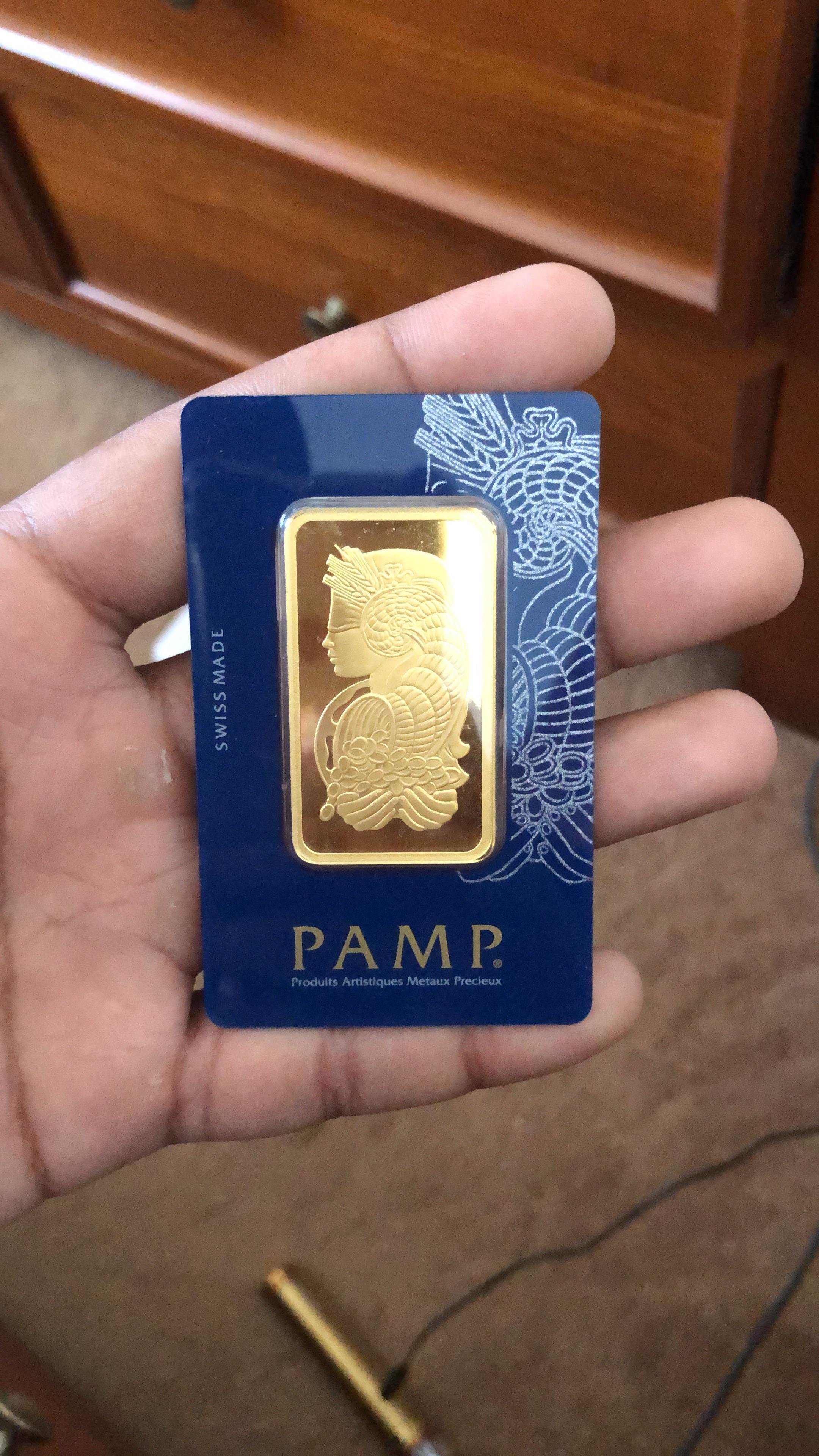

Here is the rough size of a one oz gold bar.

I trust Costco as much as the rest of you.

And look, I understand why interest in gold and bitcoin are high right now. We have inflation, record fiscal deficits, a Congress bent on spending, and worry over the debasement of the US dollar.

So, if Costco is selling gold, should I be buying it? And if so, how much?

Here are my thoughts about investing in precious metals, gold, & bitcoin.

Sketch by Adam

First lets start with some perspective.

Gold is having a moment. This chart is the GLD, which is a fund that seeks to represent the price of physical gold less the fund’s expenses. Since 1/1/2024, the GLD has returned almost 15%.

When gold outperforms you tend to hear about it. You might have heard about gold recently from your friend at work, your favorite internet watering hole, or in line at Costco.

This chart shows the year to date outperformance of GLD compared to the S&P 500 (SPY). Gold started to make its move in late February.

If you were in Costco buying gold in January of 2024, you’ve got a nice gain from your efforts.

But here’s what we know. Chasing outperformance is a poor investment strategy. The majority of people who are enjoying this move in gold have had to endure a long period of underperformance to get it.

Here’s a chart from 1/1/21 until 1/1/24 to illustrate how painful that underperformance was.

It gets even more painful the further back you zoom. Here is the relative performance of GLD to the S&P 500 over the past 10 years. The light green line is the Consumer Price Index % change, or simply, what you lost to inflation over that same time period.

And for those of you interested, here are the results over the last twenty years.

The environment today is a tinderbox for gold sensationalism.

The fear of rising inflation is the fuel that is driving gold sales. In this environment you will see advertising in places popular with certain older demographics promoting gold coins and bars. The advertisers know that retirees are sensitive to their accumulated wealth and are keen to protect what they’ve saved, so pitching gold as a safe haven represents a winning strategy for getting investor dollars. If you’re a retiree today these advertisers know where to find you (TV, Costco, Facebook, etc.) and they are good at what they do – this blog is intended to help add the counter-argument to that sensationalism.

Why investing in metals is difficult

Most of us know that we should diversify our wealth, although we aren’t always clear on how to do that. The financial press often recommends holding precious metals and gold in a portfolio, and there may be some merit to this idea. But which metal should you own, in what form, and how much?

In general, the average person is not going to trade in the futures market to get metal exposure. Our choices tend to be limited to

Holding the physical metal in the form of bars, coins, jewelry, and the family candlesticks.

Buy stocks or bonds of metal mining companies.

Buy funds which hold metals.

Some metals, like silver, copper, aluminum, platinum, palladium are used to manufacture finished goods. We call these metals utility metals. For example, palladium is resistant to corrosion and is used in catalytic converters for cars and trucks. Copper is used as a conductor of heat and electricity, and a building material. It goes into wires and is used for pipes. Silver is used in electronics for its conductivity. It can also be viewed as a store of value, and serve as a “poor man’s gold”, meaning that it could be viewed as an eventual substitute for fiat money (US Dollars).

There’s a supply & demand element to investing in metals where you may say “I think the utility of this metal will be needed in the future and the price will go up.” For instance, during COVID the price of copper saw huge increases as the supply dropped and the demand went through the roof. So much so that thieves were raiding construction sites and even people’s homes for the copper wire and pipes within them, then trading it for cash– this is what happened; the use of the actual metal became valuable to exchange for dollars.

Gold is not a utility metal. It does have utility uses, but it mostly serves as a store of value. Gold doesn’t pay a dividend, generally isn’t consumed, and subjects its owner to storage costs and unique risks.

How you can think about metals

One of the motivations for people holding gold is often exactly that— physically holding it.

Adam’s friend put it eloquently when he said “it would be pretty sweet to have some gold bars.”

Yea, it would be “pretty sweet.” … It feels good to hold actual gold or silver coins or bars in your hands.

But other than that feeling, what is the merit?

How does it fit into the framework of the decisions you make with money in pursuit of the things you want?

Gold has unique challenges to think through. Here are some of the questions I would ask myself.

How will you justify the holding costs at a bank or trust institution?

Or will you choose to self-custody the gold in your closet or safe? Will you need to install a security system to feel comfortable?

Is there a better alternative use of your capital?

In addition to the fact that the price could go down after you buy it, gold carries other unique risks including, touching your “proof” coins and marring their value, losing it, theft, or your friends convincing you to upgrade your BBQ grill a few notches (A grill of gold).

If you want to exchange your gold for stuff, then you probably need to convert to cash. When you need cash, you have to find a dealer, and that dealer may or may not offer you the best price. In fact, it's important to know you are negotiating against a professional. He or she has likely done this negotiation a million times, and this may be your first time, which is not an ideal situation to be in. The condition of your metal also affects the value. So whatever price you are seeing in the paper or online is only an estimate of what your investment is worth.

If you’re predicting an environment where dollars are not the medium of exchange because we’re in some kind of apocalyptic situation, then I’d recommend considering whether gold has an advantage as a store of value over some other item or commodity people might find more useful (canned food, ammunition, shelter, etc.).

As an investment, I’m not as big a fan of gold. I like my investments to create value while we hold them.

Here’s why.

Let’s say I have a coffee cart business, and it cost me $10,000 to start.

I buy coffee and sell coffee at a price that produces a nice little profit. That profit creates value for me.

I can choose to pay myself with that profit, or reinvest that profit and purchase another coffee cart or two. Maybe I choose to use that profit to upgrade my coffee machinery and double my output.

After many successful years in the coffee cart business, I decide it's time to do something else with my life and I start to look around for a buyer of my business.

In talking with potential buyers, the price they are willing to pay me has to be attractive enough for me to want to forgo the profits I know my cart can make if I didn’t sell it. If the price isn’t attractive enough, I can walk away and continue selling coffee and keep collecting my profits.

If the investment had no profit or value, the only way selling the business would be worth it would be to find someone who would give me more than the $10,000 I bought it for.

But because it does create value, I now have multiple paths to pursue my desired outcome.

I prefer investments that create value over time.

Stocks create value for owners by paying out dividends.

Bonds create value for owners by paying interest.

Real estate creates value for owners by paying rent.

You may argue, “Yeah, but what about stocks which don't pay dividends, like Google?” If a stock isn’t paying a dividend, it’s presumably reinvesting earnings back into the company so that it has more command over the market, which can secure a higher or more secure potential dividend in the future. In the case of Google, they have chosen to allocate earnings to buy back shares of their stock, which is like a dividend of sorts.

Now if you want to buy an income-producing asset that provides varied exposure to metals, it could be worth considering mining company stock. Mining companies do often pay dividends so that your money isn’t completely idle, and they can make adjustments to their operations when the price goes down so they can moderate the hit. But stocks move along with the stock market and are not a pure play on precious metals. I've always liked the saying, When there’s a gold rush, sell shovels… I think this sums it up pretty well for me.

Today, it is possible for a standard retail investor to hold a direct interest in gold through the use of gold ETF’s (exchange traded funds), which are a paper representation of gold held in a vault somewhere else. You will never see the actual gold, and if you lean toward conspiracy, you might question how much actual gold there is in that vault. The fund handles all the storage costs, and takes a management fee each year for running the fund, that fee comes out of the share price. If you are buying into that fund to own gold in a worst case scenario, good luck exchanging the paper IOU gold you own for canned goods or guns in a dystopian world. But the funds are easy to trade and costs are relatively low. They can provide you exposure to precious metals in a relatively simple way, just be honest with yourself what the clear purpose of your investment is.

In the case of gold, (and bitcoin) here’s how you make money.

Step 1: Buy gold from Costco for a price you think is good (Costco, what a sucker, thank you for selling me gold at that price).

Step 2: Price goes up and you sell it to someone else (Jeff, what a sucker, thank you for buying my gold from me at that price).

Harding Wealth doesn’t generally recommend commodities exposure because of our preference for assets that deliver value while they’re held even if the price doesn’t go up (yield, rent, dividends).

But you know what’s more important than my investment beliefs?

Sleeping well at night, that's what. If some gold helps that happen, I’m all for it. Just as long as the amount is moderated and it fits in with your overall picture.

After all, these aren’t just investments, they’re investments owned by people. We can all grant ourselves the grace and flexibility to buy things that make us feel a certain way….

Sometimes it’s pretty sweet to own something even if it’s not perfectly aligned with your investment principles – Just ask Adam about his Space Banana investment someday.

Cheers,

David Young

Advisor | CFP® | Costco Gold Member

*For educational purpose only. Not investment, tax, or legal advice. Past performance is not indicative of future performance.